Chris Forrester — There were more than a few episodes of Star Trek when seemingly Mr Spock would tell Captain Kirk of that week’s challenge that the life form wasn’t one they were familiar with. In reality, neither Spock nor anyone else ever uttered the words but fans would never let the truth get in the way of a wonderful catch-phrase.

But what is totally true is that the world’s geostationary (Geo) satellite operators are having to dramatically re-think their orbital strategy.

The recent SmallSat Symposium at Mountain View saw Dr. Bryan Benedict, SES’s senior director for innovation and satellite programs, tell delegates that the age of the 6-tonnes geostationary satellites was coming to an end. SES, now with Intelsat’s assets in its orbit, is the world’s largest operator of Geo satellites. Geo craft operate at 35,786 kms above the Equator. Buying Intelsat and its Geo fleet means that it has around 100 Geo craft in its overall portfolio.

“Our competition is not other Geo operators, but proliferated LEO [operators],” he said, adding that the majority of its 100-craft existing fleet will not be replaced like-for-like. “The business case for them no longer closes.”

Once upon a time, the ‘cash cow’ backbone of the SES balance sheet was Direct-to-Home television, with one signal potentially reaching millions of homes. Those days are already under threat with some major broadcasters talking about ending their satellite-based signals and switching to fibre or wireless.

Dr Benedict explained that under the traditional heritage model, a satellite paid for itself in five to seven years, generating pure profit for the subsequent decade. That window has slammed shut. “Now you might get your money back at the end of 15 years, and that’s the life of the satellite,” Benedict stated, “So that business case, when you take into account the risk involved, just does not work.”

Dr Benedict stressed that his comments were of a personal nature and not official SES policy.

He also explained that the giant 6000 kg Geo craft were being replaced by smaller, sub-1000 kg craft and where on-board flexibility mean that if one failed the network survived. This new strategy, described as seeing the Geo satellite being gentrified and replaced by smaller, cheaper and more agile structures.

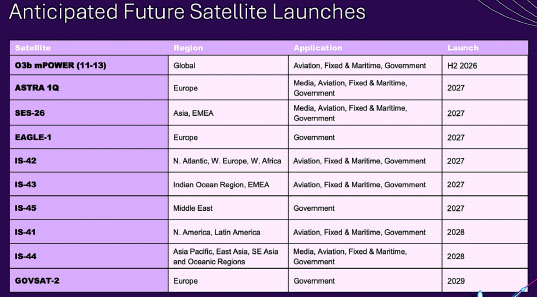

SES already has some of these smaller, cheaper satellites on order. Its ‘HummingSat’ order with SWISSto12 for 4 satellites will see the first of this new fleet launched in 2027. Viasat/Inmarsat also has plans for three HummingSats in place.

SES is also known to be looking at building its own satellites and with ordinary fleet replacement this could be a sensible concept. Thee’s also the European IRIS2 obligations to be considered and where SES is responsible for the MEO/mPOWER segment of the project.

And SES is not alone. Eutelsat announced at its February 3 half-year financial results that it had cancelled its ‘FlexSat Americas’ Geo craft, following a review of the satellite’s business case. Flexsat was a software-defined satellite Eutelsat ordered from Thales Alenia Space in 2022. This will save €100 million in future CapEx, CFO Sébastien Rouge said. “We didn’t see a viable business case,” Fallacher told investors. “The return was going much further down [in the] 2030s with Flexsat America, linked to the fact that we see more new LEO constellations coming. We decided to cancel now on an amicable basis the construction of this Geo satellite.”

Asked whether Eutelsat would ever order another Geo craft, CEO Jean-François Fallacher said: “On the Geo satellites and your question, will we ever build new Geo satellites in the future? First of all, we have one project, one Geo satellite project still live. [It is a] new Geo satellite in partnership with Thaicom, which is a satellite that will fly over Asia. It’s a connectivity satellite. So, this one we are feeling very confident, and we are really happy to keep it. We see the business plan still extremely valid over that region. Let’s remind that when we look at our fleet of 34 GEO satellites, we have a big number of Video GEO satellites. So these satellites have a long-life duration.”

Fallacher emphasised his view, saying: “So, some of these satellites will, at some point, come to an end of life, but that will be post-2035, more in the 2035-2040 region. So, probably in a few years, we will need to look at the evolution of our geo satellites, take decisions. Not much I can say now, because, I mean, you know, these geo satellites can be also moved from one place to another place. So, all of this is basically going to be looked at carefully. In the very short term, I mean, in the foreseeable short term, there is no such project, but for sure in the future, there will be additional investments in Geo satellite.”

SES already has 4 smaller Geo satellites on order with SWISSto12. SWISSto12 is also supplying three of these smaller ‘HummingSat’ Geo satellites to Viasat and inherited as part Viasat’s acquisition of Inmarsat. The contract, announced in May 2023, involves supplying three HummingSats and designed for 15-year missions in Geo orbit. HummingSats are 3D-printed, highly efficient, and significantly smaller than conventional satellites, and thus reducing deployment costs.

In other words, Arthur C. Clarke’s prophetic 1945 belief that a 3-craft satellite communication system using geostationary orbits would cover the globe, is not going to end tomorrow [Extra-Terrestrial Relays – Can Rocket Stations Give Worldwide Radio Coverage?] Indeed, viewers in Germany, for example, despite being a well-connected and near-totally fibered nation still has more than 16 million homes (44.8% market share, in December 2024, viewing on SES Astra satellites.

Other regions totally depend on satellite DTH/DBS, and while DirecTV and Charlie Ergen’s DISH are in no hurry to order new Geo satellites (DirecTV’s T16 craft, launched in 2019, is likely to be the last) it’s good to know that lower-cost HummingSats – and its rivals – could supply future demand.