Chris Forrester — You can almost smell the investment bankers and their tangible excitement over a probable SpaceX Initial Public Offering (IPO) this year. The current gossip points to a summer IPO with some Crystal Ball gazers suggesting that June 28 – Elon Musk’s birthday – is a strong contender.

But investment house ARK Funds proposed that investors needn’t wait for an IPO and could instead buy shares in businesses where they already have positions in SpaceX. Brett Winton, ARK’s chief futurist (and stressing that ARK is already an investor in SpaceX and xAI) added that there was no guarantee that SpaceX would IPO this year and it might not need the IPO. “Starlink is the fastest-growing telecom network in the world right now”.

He’s right. Starlink now has 10 million customers and there’s no sign yet of any slow-down in customer acquisitions. Moreover, SpaceX seems to have totally cracked distribution, billing and general customer services. These elements alone would be a challenge for rivals, although AST SpaceMobile will leave billing to its telco partners, while Amazon’s retail arm claims 310 million “active users globally” which should give Amazon Leo a solid start to its roll-out.

Certainly, the potential Direct-to-Device (D2D) market was a very hot topic last week at the Mountain View SmallSat Symposium in a panel moderated by Dr. Tim Farrar (of TMF Associates). Dr. Farrar was also a major contributor to a comprehensive ‘state of the US market’ cable and satellite overview sent to clients of investment bank BNP-Paribas on February 10.

Sam McHugh, a senior analyst at BNP-Paribas, compiled his report for clients which expressed some concerns over US cable.

Some of his comments are worrying:

- Comcast: “The cable business is fundamentally challenged from the relentless loss of monopolistic pricing power as infrastructure competition increases in more markets and fixed-mobile convergence becomes an increasing focus. Based on our latest STAMP results, Xfinity has deteriorated on NPS and customer satisfaction is falling, suggesting a worse broadband outlook.”

- Charter: “A highly levered cable pure-play is exposed directly to the heightening infrastructure competition in the broadband market.”

- Verizon: “At a sector view we clearly prefer the wireless / telco names over US Cable, with the latter facing a number of multi-year structural headwinds. Within the wireless segment, Verizon is our least preferred name, as their high market share and high pricing position faces several structural headwinds going into 2026.”

Set against these anxieties, the bank’s view of Starlink, helped by Tim Farrar’s counsel, is very positive.

McHugh’s report says that pressure from Starlink on fixed broadband subscriber trends at conventional ISPs is likely to increase, saying: “Tim Farrar estimates that roughly 3 million of the ~9.2mm Starlink broadband subscribers are in North America, with ~1 million using the ‘roam’ product that doesn’t compete with convention terrestrial fixed broadband services, another ~1 million have come from the legacy GEO providers (Viasat/Hughes), ~0.5mm being new to market, and <0.5mm coming from conventional fixed broadband providers (telco & cable)“.

McHugh says that Farrar believes Starlink could again target a doubling of their subscriber base in ’26 vs ’25 (as they have done in the last 2 years), i.e. towards 18m subscribers globally. To maintain this cadence of growth in the US, Starlink will need to begin taking more material share from the existing terrestrial telco and cable operators – he thinks Starlink will be willing to use price as a lever to drive subscriber growth.”

The bank’s report also examines the challenges from would-be rivals to Starlink. The bank says: “Starlink has capacity for 20 million broadband subscribers today. This could increase to 40 million [with Starlink] launching more v2 mini satellites with Falcon 9, and theoretically >150 million if Starship is successful with launching v3 satellites. Amazon LEO won’t have capacity for more than ~1.5mm broadband subs with the first 700 satellites they are planning by July. While Amazon’s full constellation would have ~5x more satellites and capacity, their launch costs alone are now going to be >$10 billion (vs. the $2-$3 billion it would cost SpaceX internally) and it seems increasingly clear they won’t earn a return on this in consumer broadband (which may be why Blue Origin has come out with TeraWave).”

The bank quotes Farrar suggesting that Starlink will be able to commercialize EchoStar’s spectrum in the US relatively quickly.

In terms of SpaceX financials Farrar suggests the revenue picture comprises: In 2025, $3bn-$4bn of annual revenue is the launch business. $3-$4 billion is government, then ~$8 billion for Starlink, perhaps 75 percent is consumer (implies $5 billion of consumer broadband revenue, roughly $50 ARPU).

Farrar also told the bank that there are at least 4 other mega-constellations are trying for Direct-to-Cell connectivity, including Apple/Globalstar. He states: “That is too many”.

At the Symposium, the panel questioned whether D2D would be a billion-dollar business or a $100 billion market globally. Farrar responded very cautiously by saying many consumers would decline paying a premium fee to the likes of AT&T or Verizon to tap into their satellite connectivity.

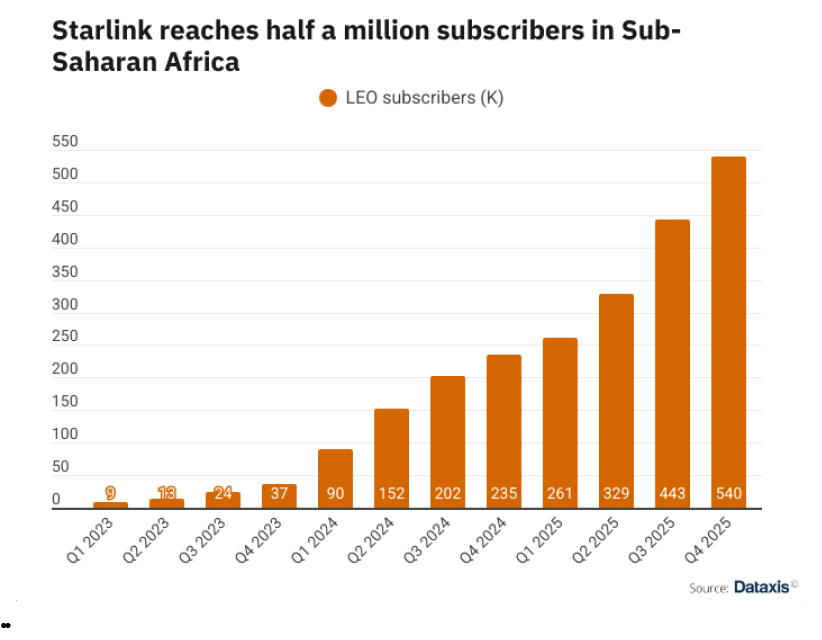

Nevertheless, there are some powerful pointers. Number-crunchers at Dataxis say that Starlink is estimated to have reached more than half a million subscribers in Sub-Saharan Africa and this is without being able to access South Africa. It is a similar story just about everywhere else. Starlink on February 12 said that it is no longer “sold out” in some busy markets. Whether Amazon Leo can encroach on Starlink’s current domination and capture a reasonable share of the satellite market is – currently – anyone’s guess. It would be prudent to expect some cost-cutting and fierce competition which might benefit consumers if not the balance sheet!

AST SpaceMobile has its head start through powerful relationships with some of the world’s most important telcos, which is why a “sooner would be better” marketing strategy is likely.

As for the others, Farrar is almost certainly right. There are too many of them!