In its fourth-quarter earnings report released on January 27, 2026, Northrop Grumman Corporation (NYSE: NOC) outlined a strategic recovery for its Space Systems segment, projecting sales to reach approximately $11 billion in fiscal year 2026.

While the company reported record total sales of $42 billion for 2025, the Space Systems unit experienced an 8% year-over-year decline in annual revenue, primarily driven by “modest headwinds” in civil space programs and the transition of several large-scale development contracts.

Strategic Pivot to Proliferated Warfighter Architectures

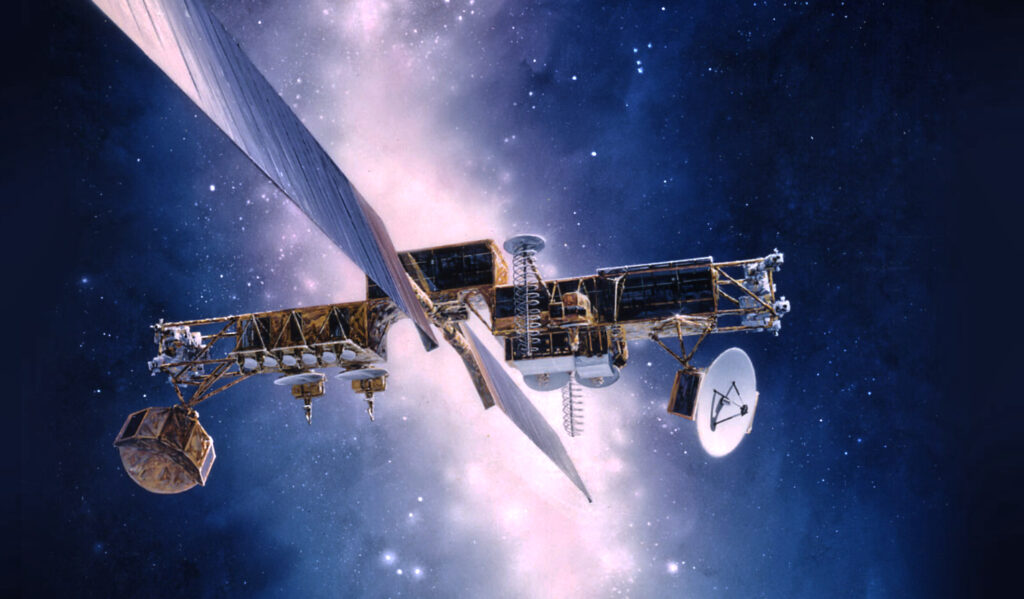

The projected rebound is anchored by the company’s deepening integration into the Space Development Agency’s (SDA) Proliferated Warfighter Space Architecture (PWSA). On December 19, 2025, the SDA awarded Northrop Grumman a $764 million contract to build and operate 18 satellites for the Tranche 3 Tracking Layer.

This latest award brings Northrop Grumman’s total commitment to the PWSA to 150 satellites across the Transport and Tracking layers. Unlike traditional bespoke satellite programs, these contracts utilize a “spiral development” model, requiring rapid production cycles at the company’s Space Park campus in Redondo Beach.

Civil and Commercial Propulsion Stabilizing

Despite the decline in the broader space segment, Northrop’s propulsion division remains a critical pillar for both government and commercial heavy-lift requirements:

- NASA Space Launch System (SLS): The company continues to provide the twin five-segment solid rocket boosters that supply 75% of the thrust for Artemis missions. Development is currently focused on the Booster Obsolescence and Life Extension (BOLE) boosters, designed to increase payload capacity for Block 2 lunar missions.

- Project Kuiper: Revenue from the GEM 63 solid rocket booster line remains stable, supported by a multi-year contract with United Launch Alliance (ULA) valued at over $2 billion to support Amazon’s LEO broadband constellation.

Rationale: Alignment with National Security Priorities

Executive leadership emphasized that the temporary dip in space revenue reflects a portfolio shift toward higher-priority restricted programs and missile defense assets. As the Department of Defense (DoD) moves to operationalize LEO as a contested domain, Northrop is prioritizing high-margin mission systems over legacy hardware segments.

“Our portfolio is aligned to what U.S. and international customers need right now,” stated Kathy Warden, Chair, CEO, and President of Northrop Grumman, during the earnings call. She noted that the company ended 2025 with a record total backlog of $95.7 billion.

2026 Financial Roadmap

For the 2026 fiscal year, Northrop Grumman has issued the following guidance:

- Total Sales: $43.5 billion – $44.0 billion (mid-single-digit growth).

- Space Segment Sales: Approximately $11.0 billion.

- Free Cash Flow: $3.1 billion – $3.5 billion.

- Capital Expenditures: Approximately $1.65 billion (4% of sales) focused on scaling production capacity for B-21 and SDA satellite lines.