Chris Forrester — CE Noticias Financieras (CENF), a well-regarded university-backed financial publication which focuses on Latino and Iberian financial news, suggests in a Jan 19 feature story that “Elon Musk has lost the space mobile race before it has even begun.” The report says bluntly: “The fiercest space race isn’t about returning to the moon.

It’s about allowing you to make a TikTok or watch Netflix on your phone anywhere on the planet, from the salt flats of Atacama to the dunes of Khongor in the Gobi Desert. To make this happen, two radically different design philosophies are at war, and several companies are building the infrastructure needed to ensure that every phone on the planet is permanently connected to the Internet.”

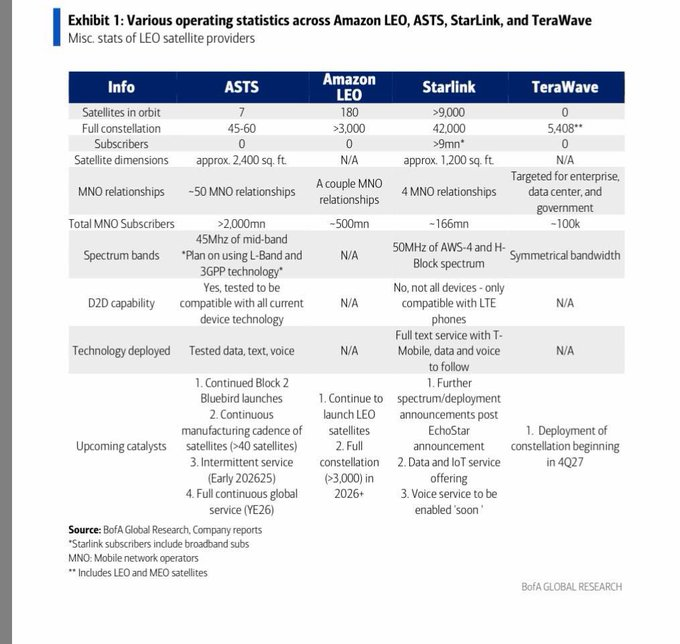

CENF compares and contrasts the two very active players, saying correctly that on the one hand there’s Elon Musk’s SpaceX and its Starlink system, and the other being AST SpaceMobile (AST), and the other wannabee Chinese players along with Amazon’s LEO and a handful of much smaller would-be operators.

But since the story was published we’ve had Jeff Bezos and his Blue Origin rocket company announce their TeraWave mega-constellation. Some observers are wondering why Bezos/Blue Origin is backing TeraWave, and sister business Amazon is backing its Amazon Leo broadband system, which would also impact the Starlink vs AST argument.

The focus on AST is justified. While Starlink has its direct relationship with consumers (currently more than 9 million, and probably well on its way to 10 million by February). But AST wants to supply its dozens of telco partners with barely 100 satellites in orbit (Elon currently has more than 9000 in orbit and wants 34,400). AST is not looking for its own relationship with consumers, depending on revenue shares with the likes of AT&T, Verizon, Vodafone, Rakuten and its many other telco friends around the world.

The eventual prize is cellular freedom and connectivity for users, or to repeat the old Martini advert: “Anytime, any place, anywhere” on the planet.

Four investment banks (Bank of America, Goldman Sachs, JPMorgan Chase, and Morgan Stanley according to the Financial Times) are drooling with the prospects of mounting an IPO this year for SpaceX, but AST is already publicly quoted and bankers are deep in their fiscal examinations and due diligence on what AST might deliver as the next year or two unfolds.

Deutsche Bank, for example, on January 20 suggests it’s important that AST launch at least 4 out of its planned 5 launches by the end of March to demonstrate launch acceleration. There’s an unconfirmed launch pending with Blue Origin’s New Glenn, probably in February. They are already 6 satellites late (from December 2025), says the bank’s report or equal to two launches, so it’s almost a certainty this initial target has been missed.

“To be clear, we don’t think it matters if the timeline slips a little (eg 1 of the 5 launches scheduled by end of 1Q slips into 2Q and/or one of the 2026 planned launches spills into early 2027). The point is that AST needs to show that it can accelerate the launch cadence and deliver a 24-hour continuous service to its MNO partners in late 2026/1H27,” stated Deutsche Bank. The bank also expects new “premium service tiers” to emerge from AST’s partners and for meaningful revenues to begin flowing next year.

“We believe that AST has the MNO partnerships in place to be successful and scale its D2D business, while also adding incremental revenue in government and potentially enterprise over time,” says the bank, which has resulted in the bank upping its price target for AST from $81 to $137 per share and reiterating a “BUY” rating.

Deutsche Bank is forecasting 3 New Glenn launches and 5 Falcon 9 launches with each carrying multiple satellites.

Other bankers are also not shy in jumping into the AST prediction business. Capital market business Clear Street, for example, has also tipped AST at $137 (from $87) and repeated a “BUY” rating and its optimism helped by the US government’s award of Golden Dome contracts to AST, saying: “We remain bullish on the direct-to-cellular market, as rising competition from SpaceX/Starlink (private) is likely to push mobile network operators to rely more heavily on AST partnerships to defend subscriber bases.”

However, CE Noticias Financieras is persuaded that fewer satellites are better for humanity than more. It quotes Jonathan McDowell, an astrophysicist and acknowledged expert at the Harvard-Smithsonian Center for Astrophysics, who says: “Personally, I prefer a smaller number of larger satellites. One reason is the risk of space collisions. If you have 10 times more satellites, you have 100 times more near misses. So, just from that point of view, consolidating into a smaller number of satellites seems more sensible.”

But that view, however, sensible, has already been lost with SpaceX’s “brute force” and proliferation of satellites. Amazon’s Project Leo plans to launch more than 3,200 satellites. Chinese companies are planning two separate mega-constellations, Guowang and G60 Starlink, with a total of nearly 26,000 satellites, and talking of 200,000+ satellites. “We are only at the beginning of this, ” warns McDowell. “And that becomes very worrying because now it’s not just one company, it’s a lot of companies.”

Which makes any sensible forecast near-impossible. China might completely upset the apple cart, while smaller players such as Canada’s Lightspeed might also play a disruptive role, as could the likes of Lynk Global, Apple/Globalstar or Abu Dhabi’s Space42/Viasat combination. However, the laser-linked TeraWave might eliminate Rivada Space Network from the potential mix.