Korea Aerospace Industries (KAI) and Hanwha Systems are competing for a 1.2 trillion won ($850 million) military contract to construct a 40-satellite synthetic aperture radar (SAR) constellation, with the South Korean government piloting a rare “develop-first, select-later” procurement strategy to accelerate deployment.

The program aims to shorten the revisit rate for monitoring the Korean Peninsula to 20-30 minutes, significantly augmenting the capabilities of the military’s existing 425 Project reconnaissance satellites, which currently visit targets every two hours.

Procurement Strategy and Timeline Unlike traditional defense acquisition programs where development follows contract award, this initiative requires competitors to self-fund the development of their satellite buses and payloads to near-completion prior to selection. The Defense Acquisition Program Administration (DAPA) and the Korea AeroSpace Administration (KASA) plan to evaluate the flight-ready hardware in October 2026, with the winning contractor scheduled to launch their first units as early as December 2026.

The 40-satellite constellation will be deployed over five launches. SpaceX is contracted to conduct the first three missions, each carrying eight satellites. The final deployments are slated to fly aboard South Korea’s domestic Nuri (KSLV-II) launch vehicle.

Technical Approaches The competing firms have adopted distinct design philosophies to meet the military’s sub-150 kg mass and 50 cm resolution requirements.

KAI has partnered with LIG Nex1 to offer a cube-shaped platform optimized for thermal management and multi-angle observation. KAI officials stated that while the central processing unit (CPU) utilizes high-reliability space-grade components, other non-critical systems incorporate commercial-off-the-shelf (COTS) automotive parts to reduce unit costs. Environmental testing for KAI’s prototype is scheduled to begin in February at the company’s Sacheon facility.

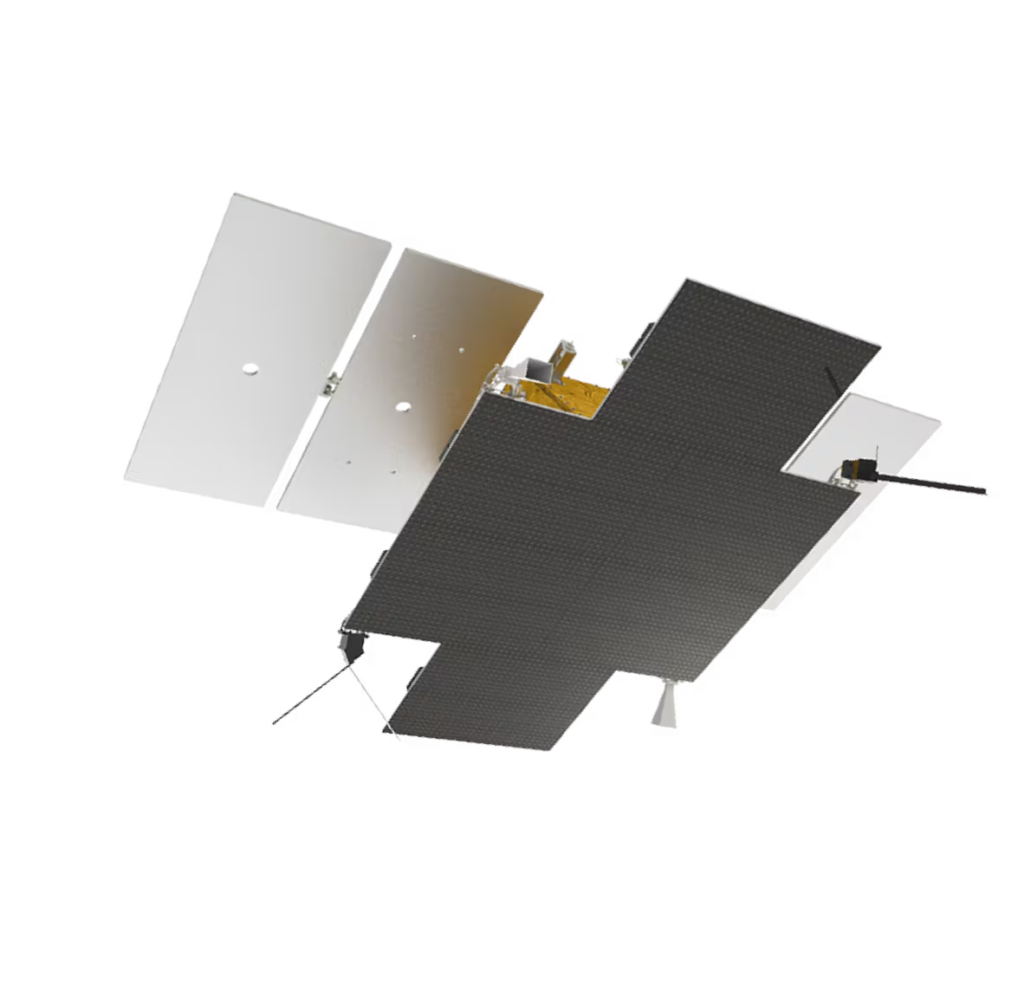

Hanwha Systems, teaming with its subsidiary Satrec Initiative, is proposing an integrated “panel-type” design where the payload, bus, and solar arrays are fused into a compact structure to maximize packing density inside the launch fairing. Hanwha is leveraging heritage from a 1-meter resolution SAR satellite it launched in 2023 and has reportedly developed technology capable of 25 cm resolution.

Commercial Synergies The program represents a shift toward mass production in South Korea’s space sector, moving away from the “hand-built” artisanal approach of previous government satellites.

Hanwha Group is positioning the bid as a test of its vertical integration strategy. With Hanwha Aerospace producing the Nuri launch vehicle and Hanwha Systems building the payloads, the conglomerate aims to control the entire value chain. Vice Chairman Kim Dong-kwan recently inspected the company’s Jeju Space Center, emphasizing the group’s focus on private-led space development.

Meanwhile, KAI is focusing on cost-efficiency through supply chain diversification, aiming to lower the barrier for mass production by validating commercial components for orbital use.

Outlook The selected contractor will be responsible for the full production run of 40 units. Following the scheduled October selection, the initial batch is targeted for a December 2026 launch to begin immediate operations alongside the 425 Project assets.