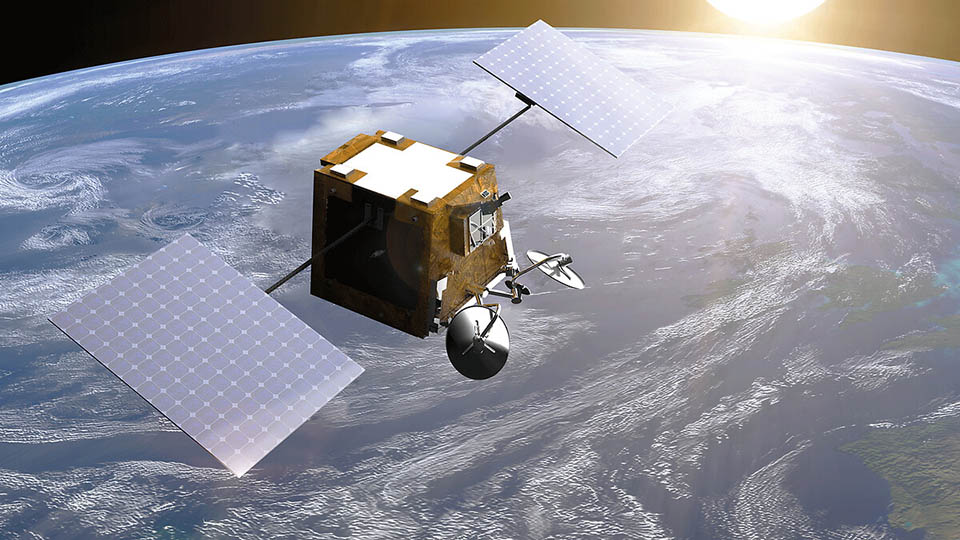

PARIS – On Monday, January 12, 2026, Eutelsat Group announced a major follow-on contract with Airbus Defence and Space for the production of 340 additional low Earth orbit (LEO) satellites. This agreement significantly expands a previous procurement of 100 satellites finalized in December 2024, bringing the total number of next-generation OneWeb spacecraft currently on order to 440 units.

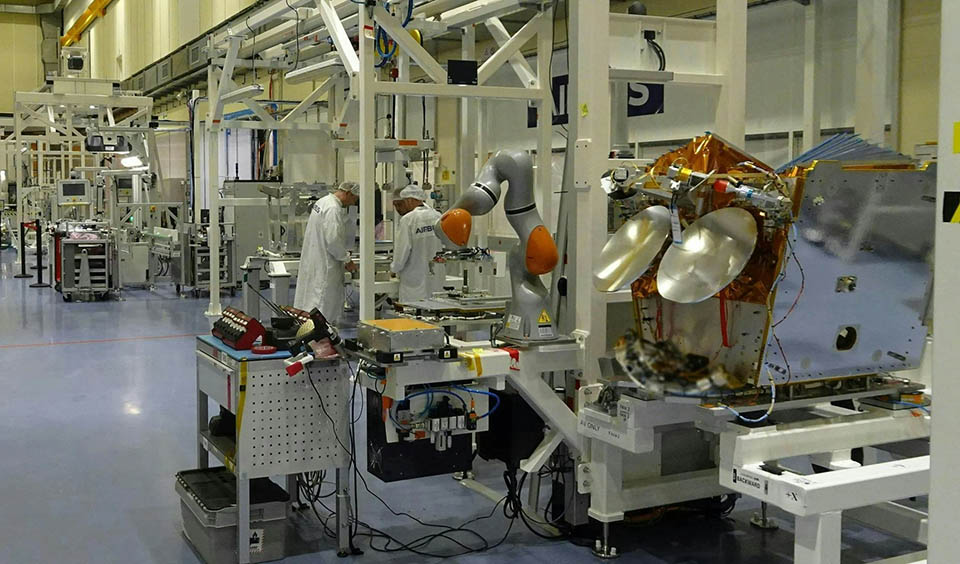

The contract is designed to ensure operational continuity for the OneWeb constellation as its earliest satellites, launched beginning in 2019, approach the end of their five-to-seven-year design lives. Manufacturing will be centralized at Airbus’s facility in Toulouse, France, utilizing a dedicated production line established to support high-cadence satellite assembly.

Technical Evolution and Multi-Orbit Integration

The 440 satellites currently under contract represent a significant technical bridge between the first-generation OneWeb fleet and the future European Union IRIS² constellation. These new units will incorporate advanced 5G on-ground integration and enhanced software-defined payloads, allowing Eutelsat to transition its architecture toward the standards required for the 2030 entry into service of IRIS².

The procurement aligns with Eutelsat’s strategic focus on a hybrid GEO-LEO model. By maintaining a robust LEO fleet, the company can provide the low-latency connectivity required for maritime, aviation, and government services, while utilizing its existing geostationary (GEO) assets for high-throughput broadcast and enterprise requirements.

Defensive Market Consolidation and Competitive Rationale

This major capital commitment arrives as competition in the LEO broadband market reaches a critical inflection point. Just three days prior, on January 9, 2026, the FCC authorized SpaceX to deploy an additional 7,500 Gen2 Starlink satellites, doubling their authorized next-generation fleet.

Eutelsat’s move to secure 340 additional satellites serves as a defensive consolidation of its market share. As legacy GEO operators face declining revenues in traditional broadcast segments, the expansion of the OneWeb fleet allows Eutelsat to maintain its position as the primary Western alternative to Starlink. The investment also solidifies the company’s role as the lead architect for the LEO segment of the EU’s sovereign satellite network, a project essential for European strategic autonomy.

Manufacturing Timeline and Delivery Schedule

Airbus expects to begin production of the initial 100-satellite batch in early 2026, with the subsequent 340 units following immediately on the same assembly line. Deliveries for the first tranche are slated to begin by the end of 2026, ensuring that replenishment units are in orbit before the attrition of the first-generation fleet impacts global service availability.

The total cost for the extension program is estimated between €2 billion and €2.2 billion through 2029. This expenditure is supported by a significant €1.5 billion capital increase recently backed by the French and British governments, who remain anchor investors in the sovereign-commercial satellite partnership.