The year has started well for space insurers. Seradata has registered only two claims so far: the loss of the Odin (Brokkr) asteroid mission for $3 million after contact was broken soon after launch, and MethaneSAT, for about $40 million, when control was lost on June 20th.

The latter was in its second year on-orbit and had renewed its insurance relatively recently. This promising start to the 2025 insurance year follows a positive result in 2024 when most space insurers made a profit.

The 2024 calendar year was a relatively uneventful one. In May, it became apparent that the communications payload on EDRS C (HYLAS 3) no longer worked and an insurance payout of $60 million (paid in euros) had been incurred.

The largest insurance claim of the year came with the propulsion related failure of the EROS C3-1 spacecraft. This was equivalent to $114 million, 63% partial loss. Some claims were withdrawn—most noticeably a $27 million claim for Gaofen Duomo (SuperView 2). However, the end of the year was marked by two more insurance loss events.

On December 27th, the launch failure of the Lijian-1 (ZK-1A) resulted in a $6.8 million insurance loss. The failure involving the rocket’s third stage, resulted in the destruction of all the spacecraft aboard—it is unclear which of them were insured. Seradata suspects the commercial spacecraft Yunyao-1 01-06 were the ones insured.

The final loss of the year was for Utilitysat which had a propulsion issue during its attempted orbital raise resulting in a total loss claim of $30 million.

The 2024 calendar year was thus a profitable one for insurers. Claims amounted to only $210.8 million against an estimated gross premium revenue (before broker deductions) of $580 million. This compares to a poor result in 2023, which had a net loss of over $1 billion. This could have been even worse if the Sarah Passiv radar satellites had not managed to shake their stuck radar antennas out.

Some insurance companies let go of staff in the space class in 2024 because it was considered too volatile. However, in some cases, the same experts have formed their own firms and consortia and re-entered the market.

Nevertheless, capacity—the overall amount of money available for each risk—remains relatively low at about $600 million, presenting problems for brokers trying to place risks at the higher end of the spectrum

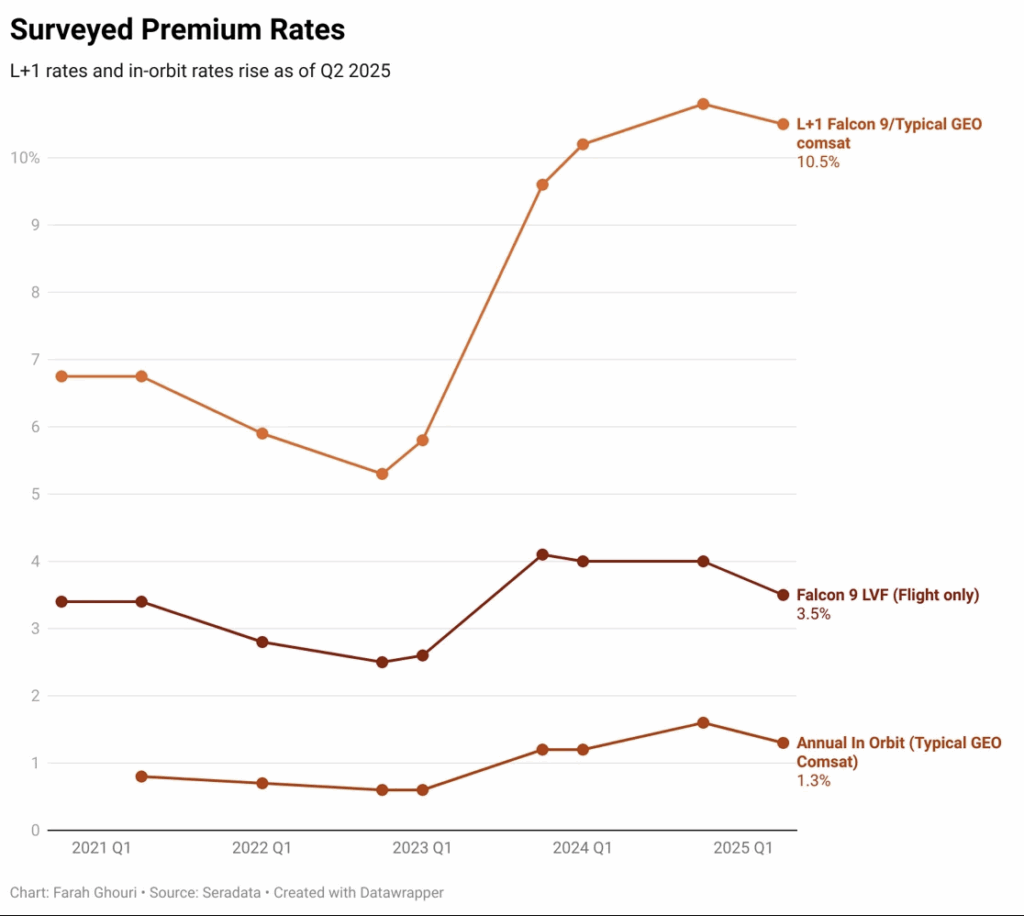

Source: Seradata underwriter survey

Premium trends in 2025

The good result last year has led to an initial fall in most premium rates, stemming their rising trend. Overall annual premium levels, in dollar terms, has stayed relatively static. A gross premium of $550-600 million is expected (typical of the last five years). Even though rates previously rose, these are yet to impact premium revenue. This is partly down to the time lag between when a rate is taken, and a rocket’s lift-off. Sometimes, the gap can be 24 months.

Launch cadence is also a factor in premium revenue. The number of insured launches remain relatively low, most recently caused by delays to new launch vehicle programs, e.g., New Glenn and Vulcan.

In general, during the first half of 2025, L+1 rates have fallen slightly. LVF rates have also fallen for some reliable rockets, e.g., the Falcon 9. The LVF rates are dependent on which rocket model is being flown and its recent reliability record. For example, the LVF rate for the PSLV has risen following a recent failure.

Nevertheless, the falls are to the chagrin of some underwriters pushing for the ‘+1’ post launch element to be higher, as recent loss experience has shown the first year in orbit to be the weak spot of spacecraft reliability.

Post-launch (after the first year) on-orbit insurance rates are also beginning to fall slightly. However, premium rates may be 0.2% higher than those quoted if the insured spacecraft is of a high insured value (i.e., above $250 million). Conclusion: the good year plus high rates has renewed confidence in the class.

The profitable result for 2024 and the encouraging start to this year has resulted in a renewed enthusiasm for space insurance. The only word of caution is that it will take a further three ‘good years’ for the losses of 2023 to be paid back.

The full report and complete survey of launch vehicle premium rates is available to Slingshot Seradata database subscribers.

Article authored by David Todd