Analysts at investment bank BNP Paribas have issued their thoughts on satellite operator Eutelsat’s current predicament and have advised clients that their rating on the Paris-based business is ‘underperform’ as far as shareholders are concerned. But worse, in that the bank’s Sami Kassab, in the past a supporter of satellite stocks, has issued a target price for Eutelsat is just €1 per share, a dramatic 71 per cent reduction to its previous target price of €3.50. February 17th trading was at around €1.39 per share. February 14th saw Eutelsat suffer a 19 per cent fall in its share price

The bank’s report says: “[Eutelsat’s] Geostationary trends are weaker than expected. We believe that the ‘increased vigilance on GEO capex’ as well as a €535 million impairment on Eutelsat’s GEO satellite fleet reflect weaker-than-expected operating trends in GEO. We think this is due to both the transition of client demand from GEO to Low Earth orbit coupled with increased competition from Starlink both in B2C and B2B segments. Management argues that geopolitical reasons (ie avoiding dependence on US or Chinese satellites) as well as customer demand for resilient services (ie having multiple competing satellite network operators) are reasons to expect Eutelsat can remain commercially relevant in the age of Mega constellations.”

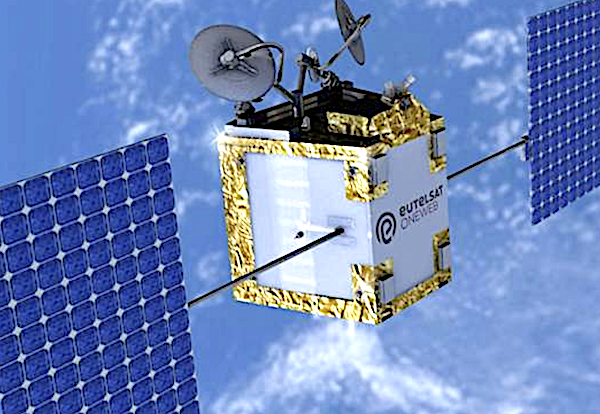

Two major shareholders (the UK government and India’s Bharti) have now seen their €500 million (each) investments in Eutelsat via its OneWeb division reduced to small change, and a division that was once valued at €3.4 billion, now in the combined Eutelsat + OneWeb business has a market capitalisation of just €820 million.