Rocket Lab USA, Inc. (Nasdaq: RKLB) has shared the firm’s financial results for fiscal third quarter, ended September 30, 2024.

Rocket Lab founder and CEO, Sir Peter Beck, said, “In the third quarter 2024 we once again executed against our end-to-end space strategy with successes and key achievements reached across small and medium launch, as well as space systems. Revenue grew 55% year-on-year to $105 million and we continue to see strong demand growth with our backlog at $1.05 billion. Significant achievements for the quarter included signing a launch service agreement for multiple launches on Neutron with a confidential commercial satellite constellation customer; successfully launching twelve Electron launches year-to-date, making 2024 a record year for launches with more still to come; signing $55 million in new Electron launches, further cementing Electron’s position as a global launch leader; and being selected by NASA to complete a study contract for a proposal to retrieve samples from Mars and return them to Earth as part of a world-first mission. We expect to close out the year strongly with more Electron launches scheduled in November and December, alongside continued progress across Neutron and space systems, that is behind our guidance for a record $125-$135 million revenue quarter in Q4.”

Business Highlights for the Third Quarter 2024, plus updates since September 30, 2024.

Electron:

- Achieved a new annual launch record of 12 Electron launches to date, with more scheduled across November and December 2024. Electron is the world’s third most-frequently launched rocket annually by vehicle type and remains the United States’ second most-frequently launched rocket annually.

- Signed several new Electron launch contracts in Q3 2024 with a total value of $55m, demonstrating an increased average selling price of $8.4m and showcasing a 67% pricing increase since the rocket’s debut launch.

- Successful Electron launches for three separate commercial satellite constellation operators in Q3, including two missions launched within just eight days. In addition to these, Electron’s most recent mission, launched in the fourth quarter on November 5th, 2024, included an expedited turnaround of just 10 weeks between contract signing and launch.

Neutron:

- Signed a launch service agreement for multiple launches on Neutron with a confidential commercial satellite constellation operator that signifies the beginning of a productive collaboration that could see Neutron deploy the entire constellation.

- Announced a federal defense contract that supports Neutron and the development of its Archimedes engine with the U.S. Air Force’s Research Laboratory.

- Doubled engine testing cadence for Archimedes over the quarter at Rocket Lab’s engine test site in Mississippi, alongside strong production execution at the Company’s Engine Development Complex in California which included multiple engines manufactured, assembled, and shipped for engine testing.

- Significant progress made across Neutron’s structures and infrastructure, including the completion of construction on the rocket’s Assembly, Integration, and Test (A.I.T.) facility in Virginia.

- Well-positioned to on-ramp to the U.S. Space Force’s National Security Space Launch (NSSL) Lane 1 program, which began accepting proposals in November 2024 to on-ramp new launch providers to an indefinite delivery indefinite quantity (IDIQ) contract valued at $5.6 billion over a five-year period.

Space Systems:

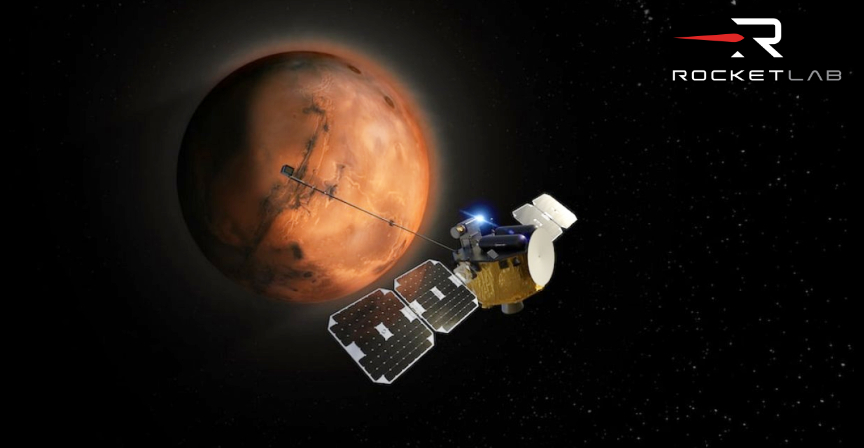

- Completed production and delivery of two spacecraft on time and on budget for NASA’s ESCAPADE mission to Mars.

- Selected by NASA to complete a study contract for a proposal to retrieve samples from Mars and return them to Earth, a first-of-its-kind mission.

- Completed two new spacecraft for Varda Space Industries to conduct the 2nd and 3rd missions to return in-space manufacturing capsules to Earth.

- Executed on schedule against the Company’s $515 million prime contract with the Space Development Agency to build 18 spacecraft for its Tranche 2 Transport Layer program.

For the fourth quarter of 2024, Rocket Lab expects:

- Revenue between $125 million and $135 million.

- GAAP Gross Margins between 26% and 28%.

- Non-GAAP Gross Margins between 32% and 34%.

- GAAP Operating Expenses between $84 million and $86 million.

- Non-GAAP Operating Expenses between $75 million and $77 million.

- Expected Interest Expense (Income), net $1.5 million.

- Adjusted EBITDA loss of $27 million and $29 million.

- Basic Shares Outstanding of 501 million.

See “Use of Non-GAAP Financial Measures” below for an explanation of our use of Non-GAAP financial measures, and the reconciliation of historical Non-GAAP measures to the comparable GAAP measures in the tables attached to this press release. We have not provided a reconciliation for the forward-looking Non-GAAP Gross Margin, Non-GAAP Operating Expenses or Adjusted EBITDA expectations for Q4 2024 described above because, without unreasonable efforts, we are unable to predict with reasonable certainty the amount and timing of adjustments that are used to calculate these non-GAAP financial measures, particularly related to stock-based compensation and its related tax effects. Stock-based compensation is currently expected to range from $12 million to $14 million in Q4 2024.

Rocket Lab signs MLA for Neutron with confidential commercial satellite constellation operator

Rocket Lab USA, Inc. has signed a multi-launch agreement (MLA) with a confidential commercial satellite constellation operator for the company’s new medium-lift rocket — Neutron.

Under the contract, Rocket Lab will launch two dedicated missions on Neutron starting from mid-2026. The missions will launch from Rocket Lab Launch Complex 3 on Wallops Island, Virginia. The launch service agreement for these missions signifies the beginning of a productive collaboration that could see Neutron deploy the entire constellation.

Rocket Lab’s Neutron medium-lift reusable launch vehicle will provide both commercial and government customers with an alternative reliable launch service capable of deploying 13,000 kg to LEO. Neutron is tailored to deploy constellations and national security missions as well as science and exploration payloads. In addition to serving customers, Neutron is key to Rocket Lab’s strategy as an end-to-end space company preparing to deploy its own constellations and deliver services from space in the future.

Neutron is strongly positioned to capitalize on the medium-lift launch requirements for future commercial and government missions, with more than 10,000 satellites projected to need launch services by 2030 in a total addressable market valued at approximately ~$10 billion*. Neutron’s expected debut launch in 2025 also puts the launch vehicle in a strong position to on-ramp onto the U.S. Government’s National Security Space Launch (NSSL) Lane 1 program, an indefinite delivery indefinite quantity (IDIQ) contract valued at $5.6 billion over a five-year period.

RFPs for the program opened on October 30th 2024, with approved new launch vehicles to be on-ramped to the program in Spring 2025. The NSSL Lane 1 program is designed by the U.S. Space Force to build up a reliable domestic industrial base of commercial launch vehicles to serve national security missions. If on-ramped in 2025, Rocket Lab would be only the fourth launch provider accepted into the program. Neutron is also eligible to compete for missions under the United States Space Force’s OSP-4 program, a separate $986 million IDIQ contract.

Rocket Lab founder and CEO, Sir Peter Beck, said, “Constellation companies and government satellite operators are desperate for a break in the launch monopoly. They need a reliable rocket from a trusted provider, and one that’s reusable to keep launch costs down and make space more frequently accessible – and Neutron is strongly positioned to be that rocket that provides choice and value to the industry. We’ve changed the game before with Electron for dedicated small launch and HASTE for hypersonic technology tests, and we’re looking forward to Neutron doing the same for constellation operators and national security.”

*Quilty Space “Satellite Demand Outlook 2023.” Excludes Starlink and Chinese and Russian satellite constellations.