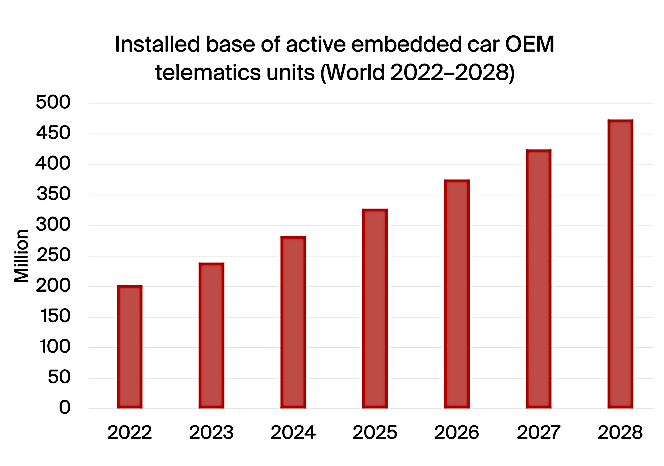

According to a new research report from the IoT analyst firm Berg Insight, the number of telematics service subscribers using embedded systems will grow at a compound annual growth rate (CAGR) of 14.6 percent from 239.7 million subscribers at the end of 2023 to 473.8 million subscribers by 2028. Shipments of embedded car OEM telematics systems worldwide are expected to grow from 59.3 million units in 2023 to reach 82.9 million units in 2028, representing an attach rate of 94 percent at the end of the forecasted period. The attach rate of embedded car OEM telematics systems in 2023 was about 75 percent globally. New passenger car and light truck registrations increased 11.6 percent to 79.3 million worldwide in 2023. The market grew for the second consecutive year and reached pre-pandemic levels. Berg Insight anticipates high growth of OEM telematics subscribers in the next years as connected car services become ubiquitous in all major car markets.

Today, most OEM telematics services focus on core propositions such as emergency assistance, roadside assistance, and remote control, which are made available as standard or premium subscriptions. A new generation of connected entertainment services has been launched in the past few years. These services include for example video and music streaming, gaming and video calls. Such services are moreover mainly available in new premium car models. Carmakers are still experimenting with business models for connected services to match customer demands better and leverage connected car data for internal purposes.

“Carmakers are increasingly bundling core services for free for extended periods to boost brand loyalty and ensure that a large portion of cars have active connections. This strategy enables big data collection to enhance product development processes and reduce warranty and product recall costs”, said Martin Cederqvist, Senior Analyst at Berg Insight.

Carmakers are gradually focusing on incorporating third-party apps into infotainment systems, providing access to the same apps that drivers have in their smartphones. Smartphone-mirroring solutions such as Android Auto and Apple CarPlay have been a way to incorporate third-party apps. Still, carmakers are increasingly focused on providing access to the apps directly through the car infotainment system, without the need for smartphone connectivity.

Some carmakers are even considering removing support for Android Auto, Apple CarPlay and other smartphone mirroring solutions in order to take charge of the connected driving experience themselves.

“Carmakers are focusing on enhancing digital driving experiences by leveraging connected car services, which are becoming an increasingly important factor in customers’ purchasing decisions”, continued Mr. Cederqvist.

Toyota Motor Group had more than 23 million connected cars at the end of 2023. General Motors and BMW had at the same time more than 20 million connected cars each. Stellantis and Ford make up the remaining top five carmakers in terms of embedded OEM telematics subscribers. Additional automotive OEMs with more than 13 million active connected cars at the end of 2023 include Volkswagen, Mercedes-Benz and Hyundai.

“In mature markets, shipments of connected cars are expected to grow in line with new car sales as the attach rate of embedded telematics systems in the future reaches close to 100 percent”, concluded Mr. Cederqvist.

Martin is an IoT analyst covering mainly the automotive sector. He performs strategic analysis of OEM and aftermarket car telematics services, data monetization services such as insurance telematics and shared mobility, among many other topics. Martin holds a Master’s degree in Industrial Engineering and Management from Chalmers University of Technology and joined Berg Insight in 2022.