Alpine Space Ventures, an industry-insider led venture capital firm dedicated to early-stage investments in the burgeoning European space sector, today announced the final closing of its first fund with a total volume of EUR 170 million.

The fund primarily targets Series A rounds to build an initial position, investing in startups that serve or utilize the global space industry, with a particular focus on the industrialization of the space sector and hardware and software solutions around connectivity and data. Alpine Space Ventures has a major focus on investments into the European ecosystem, but has some geographic flexibility to invest in the United States and beyond leveraging the team’s industry relationships especially with the early leadership team of SpaceX. A concentrated portfolio of no more than 10-15 selected investment targets will receive up to five Million Euros initially with significant dry powder reserved for follow-on rounds.

A Fund Built by Industry Insiders

The Alpine Space Ventures investment team boasts more than 50 years of building products, teams, and companies while shaping up the NewSpace industry. Founding Partner Bulent Altan has been an early leader at SpaceX having joined Elon Musk’s team initially in 2004 and overseeing the avionics development for Falcon 1, Falcon 9, and Dragon capsule and later the development of the initial Starlink satellites before leaving the firm eventually in 2017. Founding Partner Joram Voelklein has been successfully investing in tech since 2015 with a notable angel investment in launch company Isar Aerospace, together with Bulent, that made him one of the earliest backers of the European space tech ecosystem.

This expertise is further supplemented by Alpine Space Ventures’ investor base, made up of many entrepreneurs and pioneers of the space industry — including more than 20 early SpaceX employees.

Additional investors behind the fund include the European Investment Fund (EIF), the NATO Innovation Fund (NIF) and several high-profile family offices.

Concentrated portfolio

The fund that has the goal to invest in an exclusive group of no more than 15 carefully chosen startups providing key space-enabled capabilities has added five companies to its concentrated portfolio so far:

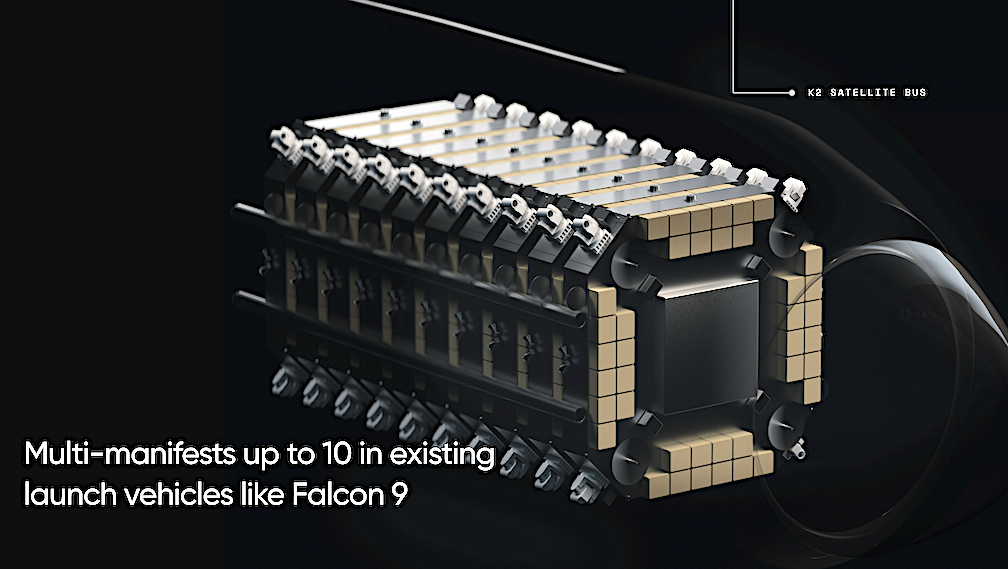

K2 Space, a satellite manufacturer of extremely capable yet cost-efficient mega-class satellites for the era of mass abundance.

Reflex Aerospace, building payload-centric and scalable spacecraft at a fraction of the time historically possible utilizing a highly modular satellite bus.

Morpheus Space, offering electric thrusters and software solutions to bring in-space mobility to satellite operators.

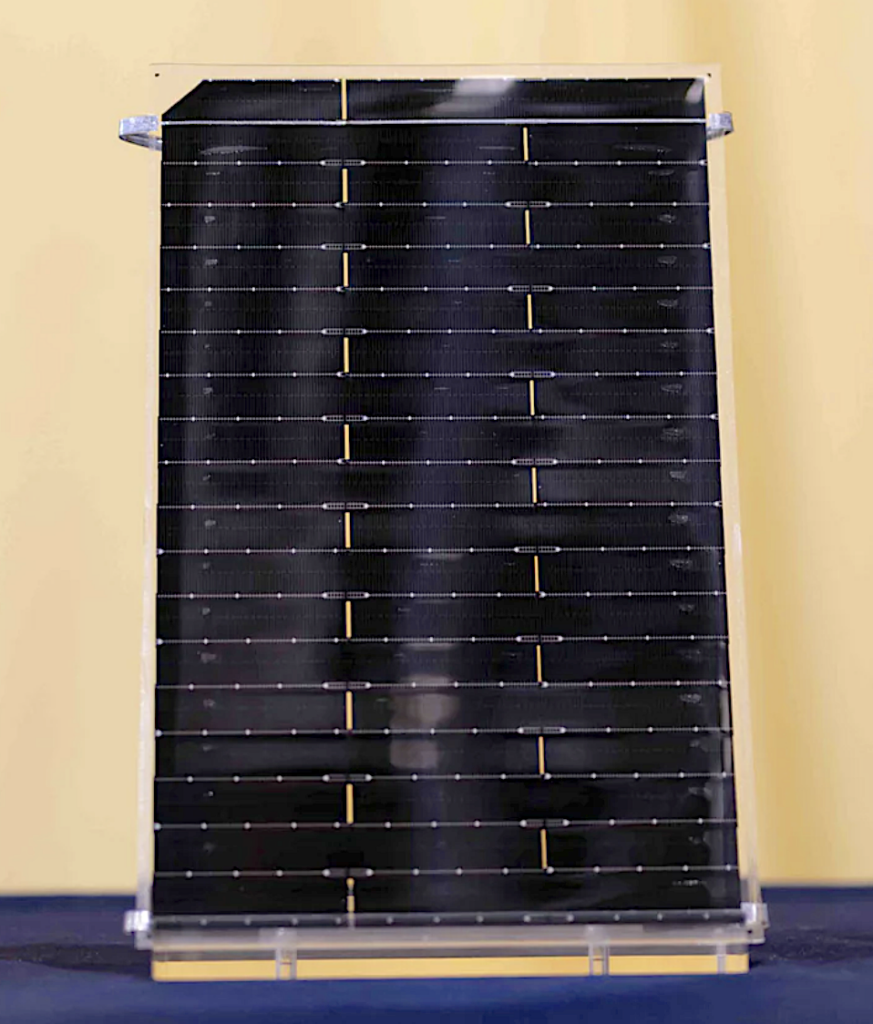

Source Energy, an off-the-shelf producer of solar panels for spacecraft cutting delivery times of flight-proven power systems from years to weeks.

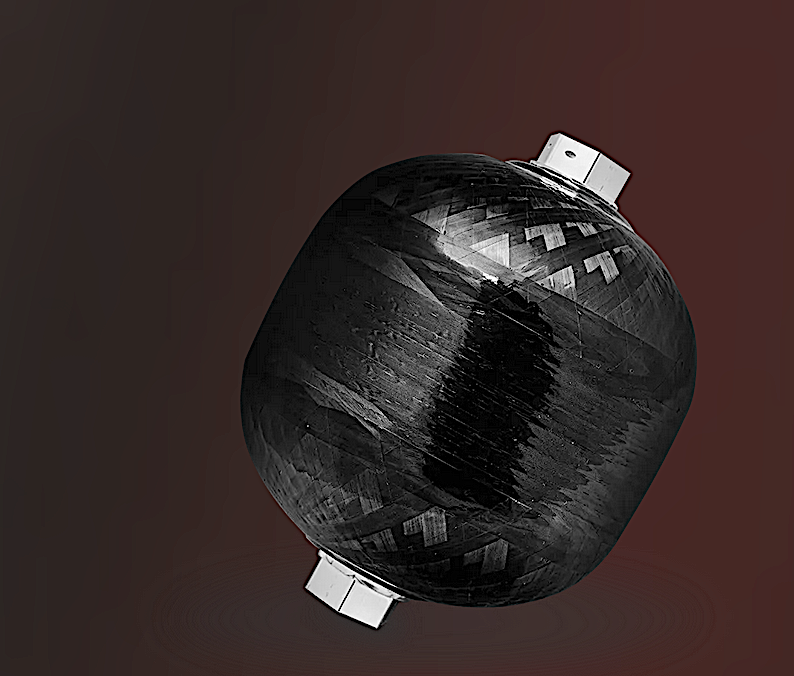

Blackwave, a series manufacturer of productized carbon-fiber reinforced pressure tanks for launch vehicles and satellite systems.

“We are looking forward to putting the fund’s capital to work and continuing to support the industry’s best entrepreneurs”, said Bulent Altan, Founding Partner at Alpine Space Ventures. “First and foremost, we are investing in the best teams with a strong market understanding, who are putting customer-centricity first, and are iterating though technical solutions quickly in their pursuit to build the best possible commercial solution.”

Karan Kunjur CEO and co-founder of portfolio company K2 Space commented, “We are the newest to have joined the Alpine Space Ventures portfolio and yet we have already benefitted from having them behind us beyond their financial commitment. Bulent is a tremendous addition to our board, and we could not be happier to have Alpine Space Ventures on our cap table.”

“Today’s a great day for the ecosystem and beyond as we are making a significant volume of smart money available to scale up space-enabled solutions globally and across industries. We are still in the early days of the European space ecosystem and I could not imagine a better time to inject further momentum into it”, added Joram Voelklein, Founding Partner of Alpine Space Ventures.

“Since day 1, Alpine Space Ventures has convinced us through their depth and industry experience“, added Walter Ballheimer, CEO and co-founder of portfolio company Reflex Aerospace. “Their technical expertise, understanding of market dynamics, and network are beyond anything we have seen so far in the industry.”

The announcement of the closing of the EUR 170 million early-stage fund comes at a pivotal moment, as Europe establishes a commercial space industry and strengthens its civil and defense infrastructure in reaction to a deteriorating climate and geopolitical environment. The fund’s final closing follows earlier announcements that included a EUR 60 million landmark investment by the European Investment Fund (EIF) in 2023 and a EUR 10 Million investment by the NATO Innovation Fund earlier this year.