An update regarding the happenings with Boeing problem solving the repair and return of NASA’s astronauts. What began as an intended eight day venture has proven to be one month as of July 6.

“We’re not stuck on ISS. The crew is not in any danger, and there’s no increased risk when we decide to bring Suni and Butch back to Earth,” said Mark Nappi, manager of Boeing’s Commercial Crew Program.

Ken Bowersox, an associate administrator at NASA, said the delay will allow for the collection of more data and that there is no hurry to bring the astronauts back. “We have the luxury of time,” he said.

The teams on-console in NASA’s Mission Control Center in Houston and Boeing’s Mission Control Center at Kennedy Space Center checked out various systems of the spacecraft with the crew, including repressurizing the propellant manifolds. They also conducted mission data loads, or MDLs, which are files for the spacecraft’s computer to understand current inertial and relative navigation states, Earth rotation, and thermal conditioning on thrusters used during Starliner’s return, and more.

“We updated some products on board to support the continued docked duration through the month of July and through the higher positive beta periods we are approaching,” said Chloe Mehring, the Starliner flight director who coordinated the power-up actions with Wilmore and Williams. “Starliner is healthy and no anomalies were written against the spacecraft.”

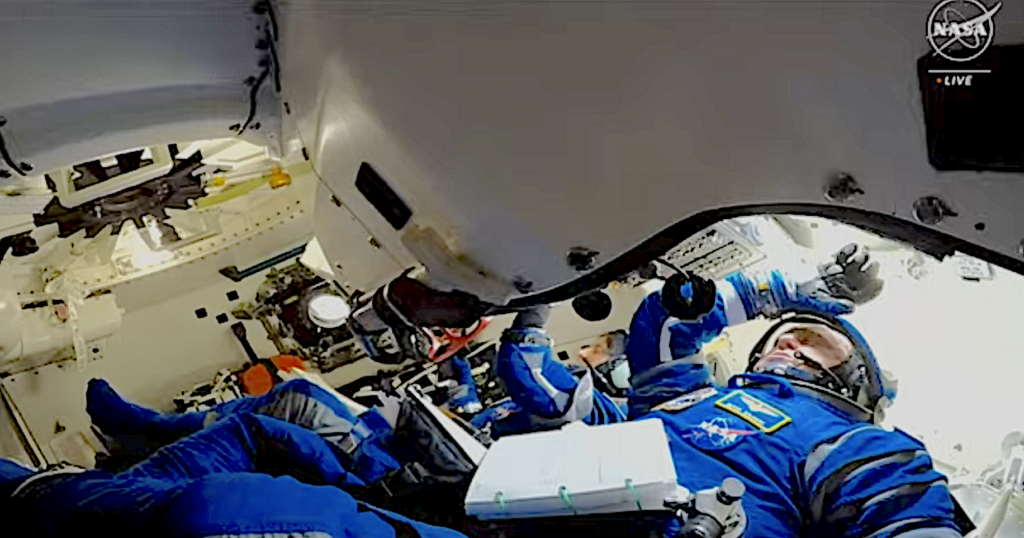

At the last few minutes the astronauts’ nerves are beginning to show. Photo captured on Saturday, June 1, by Satnews from ULA video stream.

Beginning this week, teams will run the thruster through similar conditions that Starliner experienced after launch on the way to the space station. The tests will include replicating the phase of the Crew Flight Test from launch to docking. Then tests will be performed to replicate what thrusters will experience from undocking to landing.

“We really want to understand the thruster and how we use it in flight,” said Dan Niedermaier, the lead Boeing engineer for the thruster testing. “We will learn a lot from these these thruster firings that will be valuable for the remainder of the Crew Flight Test and future missions.”

Additional Operational Checkout Capabilities (OCC) that were added during testing included tablet and procedure updates. Camera and tablet batteries were also charged while the spacecraft was fully powered up. Before launch, NASA had said the batteries aboard Starliner were rated for 45 days but during the press conference they indicated they were performing well and would be rated to last another 45 days. On regular missions to service the station, Starliner would stay docked for six months.

Both Boeing and SpaceX received multibillion-dollar contracts in 2014 to develop their projects. Since 2020 SpaceX’s Crew Dragon capsule has carried more than half a dozen crews to the ISS. Boeing has conducted two remote flights, one that failed to reach orbit and a second in May 2022 that docked with the orbiting lab.

The current mission with astronauts aboard was scheduled to launch last year but was delayed due to the need to replace flammable tape used extensively in Starliner and a second issue with the parachute system that will slow its descent for a ground landing in the Southwest.

Last month SpaceX, now valued at a record $210 billion, was awarded a NASA contract worth as much as $843 million to build a spacecraft to guide the International Space Station out of orbit so it can burn up in the atmosphere when it is retired in 2030.

Should Boeing’s Starliner get certified, the dismantling of the space station would offer several scheduled service flights. Due to this small number of possible transports there is speculation that Boeing may end the program. Boeing states that Starliner could still be used to service the Orbital Reef orbiting station under development by Jeff Bezos’ Blue Origin company.

Additionally Boeing [NYSE: BA] announced it has entered into a definitive agreement to acquire Spirit AeroSystems [NYSE: SPR]. The merger is an all-stock transaction at an equity value of approximately $4.7 billion, or $37.25 per share. The total transaction value is approximately $8.3 billion, including Spirit’s last reported net debt.

Each share of Spirit common stock will be exchanged for a number of shares of Boeing common stock equal to an exchange ratio between 0.18 and 0.25, calculated as $37.25 divided by the volume weighted average share price of Boeing shares over the 15-trading-day period ending on the second trading day prior to the closing (subject to a floor of $149.00 per share and a ceiling of $206.94 per share). Spirit shareholders will receive 0.25 Boeing shares for each of their Spirit shares if the volume-weighted average price is at or below $149.00, and 0.18 Boeing shares for each of their Spirit shares if the volume-weighted average price is at or above $206.94.

“We believe this deal is in the best interest of the flying public, our airline customers, the employees of Spirit and Boeing, our shareholders and the country more broadly,” said Boeing President and CEO Dave Calhoun. “By reintegrating Spirit, we can fully align our commercial production systems, including our Safety and Quality Management Systems, and our workforce to the same priorities, incentives and outcomes – centered on safety and quality.”