Unseenlabs has closed a fundraising round of €85 million.

This new funding round brings together leading investors: Supernova Invest, ISALT via its Strategic Transition Fund, and UNEXO. All of Unseenlabs’ historical partners, including 360 Capital, OMNES, Bpifrance, Breizh Up managed by UI Investissement, and S2G Ventures, also reaffirm their support for this new phase.

The strategic allocation of funds will focus on:

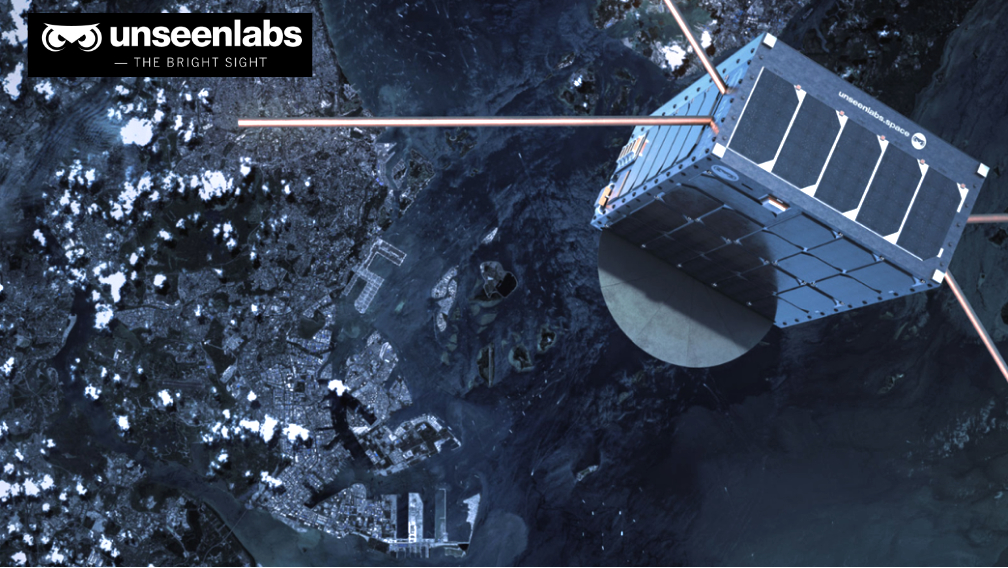

- Significant expansion of observation capabilities, with the launch of multiple satellites

- Strengthening Unseenlabs’ international presence, particularly in the American and Asian markets, crucial for the maritime sector

- Consolidation of activity within private sector segments such as oil and gas, insurance, shipowners, economic intelligence, or offshore energy

- Innovation and deployment of new products and solutions, thereby reinforcing Unseenlabs’ position as a leader in RF maritime surveillance solutions

Next month, Unseenlabs will launch two new satellites, BRO-12 and BRO-13, aboard SpaceX Falcon 9 as part of the Transporter-10 mission from Vandenberg Space Force Base (USA).

“Unseenlabs has accumulated a total funding of €120 million since its inception. This reflects our steady progress and the continued confidence of our investors. The year 2023 marked a turning point for Unseenlabs, consolidating the relevance of our business model and the attractiveness of our offering in the market. This funding will allow us to accelerate our growth, particularly by developing new solutions and strengthening our presence in the private sector. We are excited to continue this journey with our historical partners while welcoming new ones,” said Chief Executive Officer, Clément Galic.

“Unseenlabs stands out for its innovative approach and its ability to redefine the standards of space observation of radio frequencies. We are convinced of its potential to stay a major global player. The decisive factors of our investment lie in their disruptive technology and the value-addition of their data, crucial for both state maritime missions and private sector markets,” said Etienne Moreau, partner at Supernova Invest.