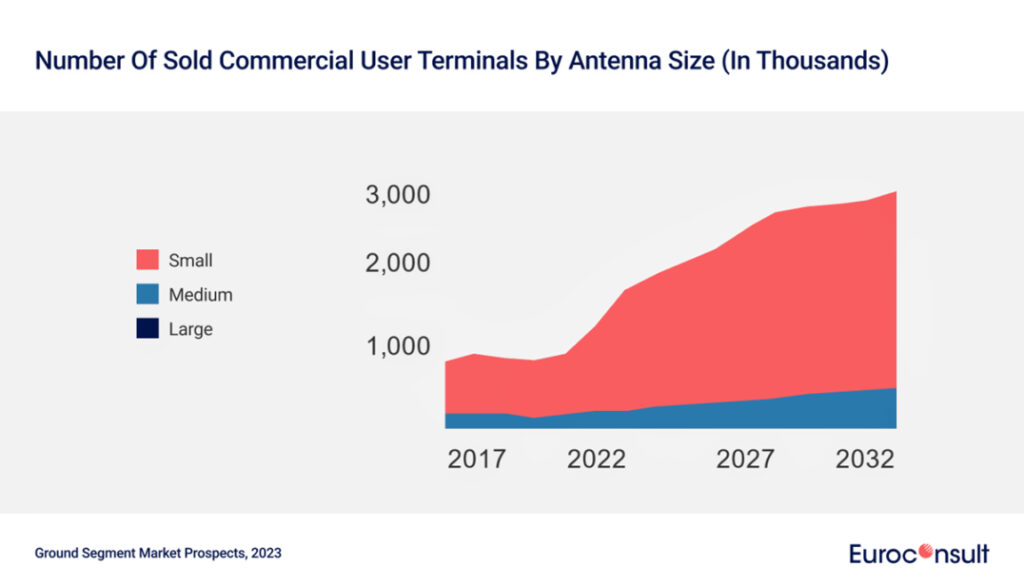

Euroconsult’s market intelligence predicts that non-geostationary (NGSO) constellation deployments will be a primary catalyst, leading to an increase by a 2.3 factor in the number of commercial user terminals by 2032, translating to an impressive 8.7% Compound Annual Growth Rate (CAGR).

Flat Panel Antennas (FPA) also represent a massive growth area and will account for 74% of the sold commercial user terminals by 2032 compared to about 45% in 2022. The report highlights how the commercial user terminal market is benefiting from robust growth across various verticals. This expansion ranges from achieving universal broadband access to catering to the needs of mobility industries, enterprises, and government clients. Market demand is encouraging the development of terminals that seamlessly switch between LEO, MEO and GEO, enhancing performance and resiliency.

Providers offering satellite-to-ground communication services, such as GSaaS, are enabling satellite operators to shift ground segment costs from capital expenditure (CAPEX) to operational expenditure (OPEX), mainly driven by EO requirements. It’s particularly relevant for new operators testing their business models and aiming for progressive scaling. The Ground Station as a Service (GSaaS) market grew at an 11% CAGR during the last five years and is expected to continue expanding to reach $400 million by 2027.

At ground station level, specific trends are emerging in different segments. Across the commercial sector, robust investments in High-Throughput Satellite (HTS) and Very High-Throughput Satellite (VHTS) systems, particularly in NGSO constellations, are driving growth in the data and services market. In contrast, the broadcast market is experiencing a decline, influenced by changing consumer behavior and terrestrial competition.

A renewed focus on defense satellite systems is also shaping the ground segment market. Modernization cycles are being propelled by the launch of new satellite systems, with the U.S. set to introduce new space assets and satellite systems, and several other countries in Europe and Asia following suit. As the increase in data & services market and defence does not counterbalance the decrease in broadcast, the number of sold ground stations should remain quite stable over the 2023 – 2032 period and reach 1,700 units in 2032.

The Euroconsult report underscores the positive outlook for the ground segment market and highlights the pivotal role of NGSO constellations, software-defined solutions, and segment-specific trends in shaping the industry’s future.

“The dynamic evolution of the space segment, with flexible payloads and constellations, underscores the need for adaptable ground infrastructure to support advanced communication needs. The development of software-defined solutions at both space and ground levels will remain a major driver for ground segment manufacturers. These solutions encompass virtual functions that optimize capacity utilization, reduce costs and enhance overall efficiency, including software-defined networking, virtualization and cloud technologies.” — Jean Benoit Laithier, Principal Advisor, Euroconsult.

‘Ground Market Segment Prospects’ is available now and can be ordered from Euroconsult’s Digital Platform and is now offering a free extract for download.