The synthetic aperture radar (SAR) market is expected to register sizable growth over the coming years credited to emerging cloud platforms such as Amazon Web Services which allows users to conveniently and quickly access SAR imagery and data. The introduction of analytical tools and web portals for SAR data processing is likely to drive industry expansion.

There is a surge in demand for innovative technologies which give situational awareness. SAR provides enhanced image processing capabilities and high spatial resolution. Defense agencies and government authorities are increasingly focusing on the development of space programs and strategies, hence boosting the demand for SAR systems.

Firms operating in the SAR market are also working on advanced technology and product development as well as collaborations. For example, in 2020, the ESA (European Space Agency) announced SAR technology firm ICEYE as their data provider under assessment via its Earthnet Third Party Mission program, where ESA sponsors the cost of access to ICEYE’s SAR data for earth observation and research based application development.

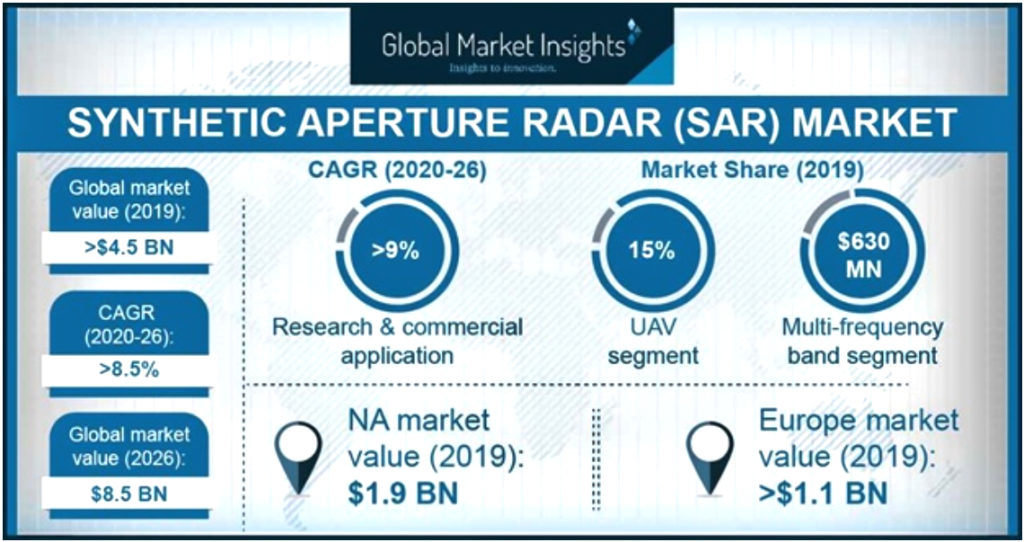

With such strategic initiatives, Global Market Insights, Inc., reports that the synthetic aperture radar (SAR) market may surpass USD 8.5 billion by 2026.

Mentioned next are some of the key trends driving synthetic aperture radar

market expansion:

- Robust adoption of K/Ka/Ku frequency band SAR

The K/Ka/Ku frequency band SAR segment is likely to showcase considerable growth owing to rise in SAR surveillance and monitoring in harsh climatic conditions. The K-band frequency is widely used in various short-range applications. Improved capabilities to control the radiation patterns to achieve multi-mode imaging techniques are fueling its adoption in radars.

- Surge in government initiatives

Government initiatives to protect the public from environmental and man-made hazards are on the rise and are expected to boost the commercial and research applications of synthetic aperture radars. Several regional organizations are also adopting SAR imagery for tracking oil spills, in order to save people as well as to ensure the safety of marine ecosystems.

- Multiple development strategies by firms

Several companies are focusing on creating miniature SAR with advanced technologies in order to cater to the increasing demand in many end-use applications. They are also making efforts to reduce the development costs of synthetic aperture radars to enable their commercialization. SAR firms are investing in research & development activities for the designing and demonstration of new technologies in the area of remote sensing.

For instance, in 2020, SAR provider Capella Space unveiled its advanced, highest resolution commercial SAR imagery, having a 50cm x 50cm resolution in the new, specialized Spotlight or ‘Spot’ imaging mode, that gives a crystal-clear SAR imagery.

Article authored by Vinisha Joshi