The 2020 Satellite Industry Association state of the satellite industry report estimates that the ground equipment market is approaching the $130 billion mark of the overall $271 billion in global revenues. Providers of ground equipment and services compete on breadth and quality of service. Ground systems for smallsats need fully integrated systems that are fully motorized and capable of auto-acquisition. These systems need to deal with a variety of orbits from LEO through GEO.

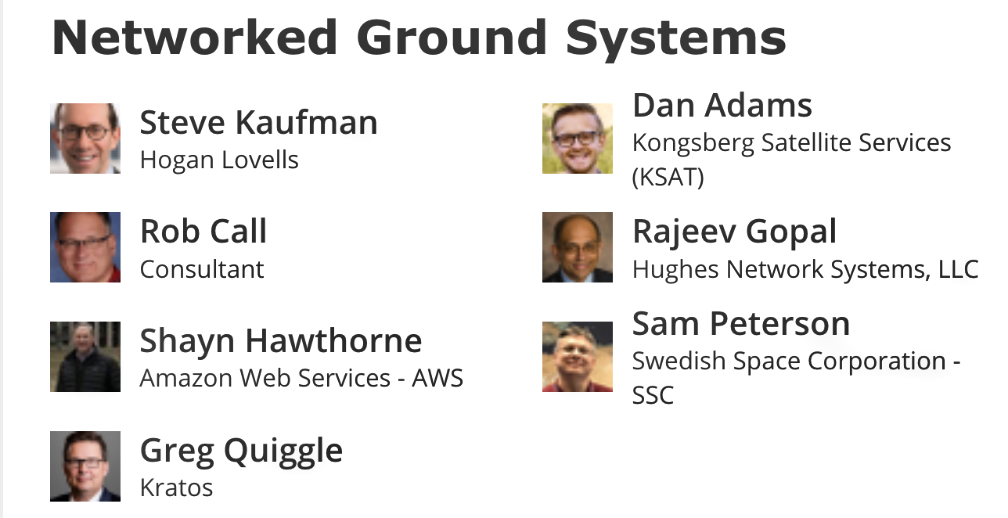

During this symposium, it is truly amazing to hear and see what is being built. Greg Quiggle of Kratos noted that 10 years ago, optimal placement of antennas was the norm and, nowadays, its access to the cloud. Mr. Quiggle mentioned that Kratos makes ground services infrastructure and the hardware and processing gear.

Ground Systems as a Service (GSaaS) is a huge trend for his company and is typically used with Occasional Use (OU) networks. An antenna is shared with other users, the spectrum is digitized at the base of the antenna, then spun up to the cloud, processed, and the data is downloaded for monetization. He said ground systems have worked their way into the cloud architecture, offering shared antennas and so on. He recognizes that ground segment pricing is rising and that’s a problem for the industry.

On the imaging side, however, there has been a notable drop in ground segment costs, y-o-y. Many customers have been asking for their networks to be handled far more dynamically. The payload should be able to be reconfigured multiple times per day, if necessary. Customers are asking to leverage the elastic nature of the cloud.

He then dove into 3GPP and how this global initiative is all about leveraging non-terrestrial air interfaces. He believes in getting space to work as an access network within the 3GPP core network. “Why can’t space be liked cell phone nets?” he asked. He said that 3GPP is a huge working group that is releasing standards all should contemplate. “The door is open for space to participate in those standards, making space another air access net.”

Also, he mentioned that ground networks have advanced over the past 10 years and there more antennas, more placements and more connectivity available. An additional thought was that optical comms will be a game changer and optical solutions will provide additional benefits. On a final note, Mr. Quiggle mentioned that Kratos already has a virtual, digital X-86 based satellite mode that is able to process hundreds of mega symbols.

Moderator Steve Kaufman of Hogan Lovells queried the panelists about the difference between providing ground systems and Ground Systems as a Service (GSaaS)… what are most of the customers/buyers doing in that regard and where is the market growth coming from? He also wanted to know if the panelists were actually competitors.

Dan Adams of Kongsberg Satellite Services (KSAT) believes the market is predominately GSaaS and there are nuances about what that means to different customers. Communications from spacecraft to the ground to ops centers with data, that’s provided as a service. Customers don’t have to own their own antennas or ground services — there are no dedicated assets by the client company. If you are trying to be all things to all people, it all boils down to making your service totally accessible to the customer — it needs to be productized and made easily available. His company took many of they tools they use behind the scenes so that the services they offer are transparent to the customer. All of the complexities were removed and the firm is working on the next, iterative step to ensure customer flexibility and service reliability. He considered the “functionality versus cost” issue and remarked that the final answer depends on the customer. He said cost is sometimes not an issue, especially when you have the capacity and discovery combination. He said that intersatellite links are the future, but that will not eliminate the need for ground stations.

Shayn Hawthorne of Amazon Web Services doesn’t really view anyone on the panel or in the space community as competitors. They are “fellow travelers.” He explained that more than 100 of the payloads on the recent SpaceX Transporter-1 launch are AWS users. Mr. Hawthorne noted the company is not seeing clumping or a division of competitors and that customers are starting to work together — much more collaboration and integration of people’s data is occurring. He believes success comes when these actions are made fast and become low cost so that all becomes ubiquitous.

Also, price creep may be seen working its way into LEO and there is a definite need for more ground stations to be built. The tendency is toward vertical integration in the market. Cloud services allow a company to put their money into the satellite and operations and use someone else’s resources for data analysis. He recommends money be spent on the projects and leave the infrastructure stuff to the people on this panel.

The main thing he’s hearing is customers definitely being want to be able to work with the government in classified regions. AWS manages that for a lot of customers, especially imagery providers who need to get their data into secret and top secret regions. AWS gets to those regions and processes the data. He believes data should be processed in real time at the antenna and possess low latency.

Plus, customers want to be able to talk to their spacecraft more often everyday. “SDN is really what’s coming,” he said. “You have to have flexibility, agility, and have a Software Defined Network (SDN) that changes to meet customers’ needs — that’s the key. One challenge we all should focus on is that there’s a lot of new SDN’s coming and we should be applying that technology to every satellite in the world — dirt cheap apertures, multiple beams from multiple satellites to a single point — instead of thinking about owning their own ground station. Customers in space deserve that level of seamless connectivity. There’s incredible change in how people are actually ‘doing space.’” He added, “I can see a future with SDN — compute and networking will occur directly at the antenna. Ground station antennas will be connected to LEO and integration of all services and technology will occur. Ground stations can, and should, all converge.”

As far as optical communications are concerned, he indicated that will be a great technology “when we get to point where customers are ready to use that tech. Right now, to become a game changer, optical teams need to work with the cloud team for a kind of convergence, such as occurred within the RF world.”

Mr. Hawthorne completed his thoughts by noting that everyone should be designing their systems to work with intersatellite links.

Consultant Rob Call believes partnerships in the interest of the customer are productive for them and the industry; however, more standards are needed. The trend is toward GSaaS, especially with government users. Government customers are actually making a big change and heading into commercial services.

Low latency is being demanded by customers, and other services are optional, and he said get the processing on the ground. An organization has to look at performance as a huge issue that must be addressed as quickly as possible. He did note that other aspects of space have advanced more rapidly than ground networks. There are greater advances in virtualization and moving to 5G. He noted that some companies adopt more terrestrial standards and then use them for space activities.

“With managed service, we see lots more unification,” said Rajeev Gopal of Hughes Network Systems. His firm works on GEO satellites and gateways for their constellations. His mantra is Observation, Communication and Broadcast, as far as ground systems are concerned.

Concerning audience size and the scale of networks that are supporting satellites, a question was posed by the moderator wanting to know if there was a natural limit to the networks. Mr. Gopal said it used to be around 10 to 50K users at the start but now is around 100K or more on the same satellite. LEO constellations are now being designed for millions of terminals and it is no longer tens or hundreds, but millions.

Sam Peterson of Swedish Space Corporation (SSC) agrees that the trend in recent years has been toward GSaaS. There are some models where firms want to own their own infrastructure as they already have a network in place and own land and are already located all over the world — all they wish to do is put their infrastructure on your site. He sees trends regarding functionality versus costs — smallsat firms typically want a low frills, low cost network.

There are new capabilities coming online, such as optical communications and mission profiles require better performing systems and better SLAs. Networks are being increased to handle more data. Additionally, ground tracking for the increasing number of manned space systems require more and more demand of ground stations.

Regarding networks size and the number of users, Mr. Peterson said that depends on the operator. LEO apps can store a lot more data onboard these days and that data can be dumped during the smallsats’ one or two passes over a ground station per day. With different concepts of operations, a company may not need a distributed network, as it would be more cost effective to go and get a service for when and where the firm needs such support.