Spain was recently hit with a severe snowstorm, resulting in heavy snowfall and the coldest night in over 20 years. Imagine, for a moment, that you wished to assess the damage caused by the storm on a national level. How would you go about this?

Satellites, given their constant surveillance and coverage capabilities, are a natural fit for Earth Observation (EO). A single satellite, with the correct resolution and altitude, could take a snapshot of the country, and the correct expertise and tools would allow you to assess the extent or the snowfall, especially when compared with historical imagery. However, the actual process of procuring the imagery, and assessing it, is not so simple.

What we want is a subscription-based, ongoing, open catalog, where imagery can be selected, manually or autonomously, feeding into our product and analytical pipelines. Instead, we have dozens of companies, and more on the way, offering imagery in different amounts, on different terms, pricing models, even resolutions.

What we want is Netflix, but what we have is Blockbuster.

Given the challenges here, how will this sector, and the EO market, grow/change over the next decade?

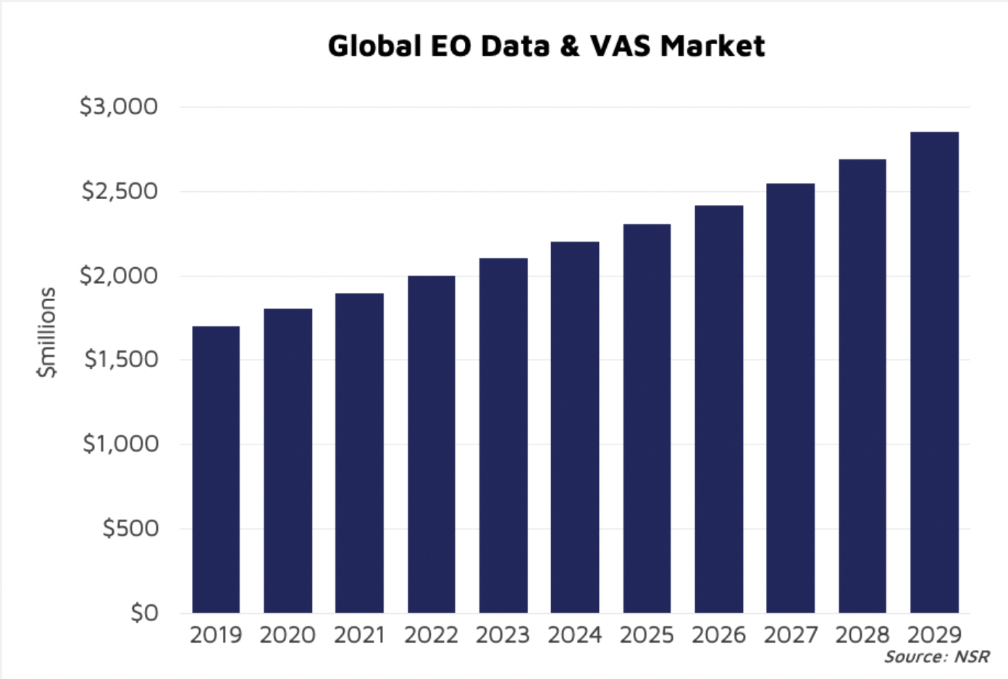

NSR’s Satellite-Based Earth Observation, 12th Edition report forecasts annual revenues from the sale of EO Data and Value-Added Services (low level image processing) will grow from $1.8 billion last year to $2.9 billion by 2029, at a CAGR of 5.3%. Supply is dramatically increasing, with an estimated 1,060 EO satellites announced to launch in that period, greatly expanding the imaging and global monitoring capability.

However, having petabytes of imagery is worthless if it is not leveraged properly, and here are where the obstacles and opportunities come into play. Standard or Custom?

The single greatest obstacle to the widespread adoption of satellite imagery and EO player growth is the lack of standardization.

From a technology standpoint, every supplier’s image is a different size, spatial and spectral resolution. Currently, there exist gaps in historical and global coverage, which often require downstream analytics firms and end users to compare imagery across providers. That comparison can be time-intensive and expensive, adding a complication to the process. From a customer perspective, this makes purchasing imagery that much more challenging. Rather than having standard metrics for pricing and serving imagery, every EO provider has their own subscription service, featuring different volumes, resolutions, terms, with pricing inconsistent across the board.

NSR expects the data market to remain focused on government & military customers, whose larger budgets, longer-established history, and better-defined requirements more easily overcome these challenges. As such, Defense & Intelligence and Public Authorities will be responsible for 65% of all EO Data & VAS revenues, growing from $1.1 billion to $1.9 billion between 2020 and 2029.

Going back to our example, what started as a wish to purchase recent imagery of Spain, hoping to follow the Netflix model of choosing what to watch, has us instead faced with having to shop across different streaming services, each with their own pricing, capacity, and restrictions.

However, this has provided an opportunity for a middle layer of imagery brokers and data aggregators, to emerge. Most are creating their own virtual constellations, which aim to standardize and allow cross-comparison of offerings across the market, and others have begun creating data refineries and pipelines, which aim to provide ready-to-use data for specific customers and applications.

The dream for EO is to eventually shift away from imagery toward insights, from single-purchase to ongoing subscription of actionable and easy-to-use intelligence, but in order for the Big Data ecosystem to evolve, the Data process must be harmonized. Bottom Line

The EO industry will continue to face growing pains. The transition from low-volume purchase to continuous monitoring via constellations will require more than time and investment for satellite manufacture and launch, but also for standardizing offerings to allow a smoother purchasing process. The expansion of analytical tools has allowed EO to expand beyond niche and traditional, imagery-savvy customers, but if the purchasing process remains burdened by inconsistent coverage, pricing, volume, and data standards, the market will never grow with the times, expand to the widest possible customer base, and may end up going the way of Blockbuster video.

Article by Dallas Kasaboski, NSR Senior Analyst,

Strasbourg, France