In its annual publication focused on the current and historic performance of Fixed Satellite Services (FSS) companies, Euroconsult reported increased competition and strong impact from COVID-19 in this $10.8 billion market (excluding vertically-integrated operators). Operators are adapting to remain relevant in the long term and to weather the storm in 2020-2021, with the ongoing pandemic impacting the global industry.

More than half a year after the start of the Covid-19 crisis, there are clear indications that the FSS industry has been negatively impacted. Most publicly listed operators reporting on a quarterly basis have reported lower revenues for 3Q 2020 vs. 3Q 2019. After the first three quarters of the year, these companies have reported revenues down an average 4% year-over-year.

“Operators with exposure to the mobility market have suffered the most from the Covid-19 pandemic,” said Dimitri Buchs, Senior Consultant at Euroconsult, and author of the report. “However, revenue declines appear to be decreasing as the year progresses, maybe a sign of what to expect in 2021.”

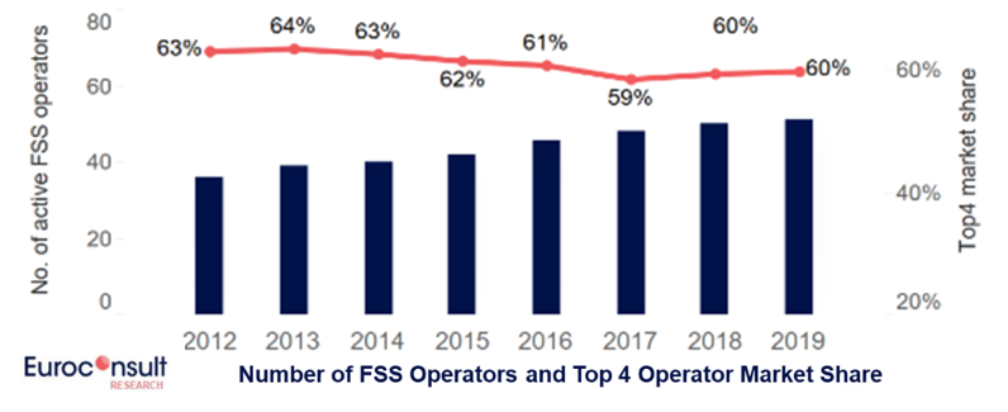

In 2019, the top five FSS operators represented 64 percent of the industry revenues and 20 operators had revenue of more than $100 million. Demand for satellite capacity increased by 18 percent to reach 1,425 Gbps. Eight new FSS operators emerged between 2017 and 2020 and six more are expected to enter the market between 2021 to the mid-2020s.

The research shows that nearly half of the FSS operators increased the number of regular transponders leased throughout 2019 and service revenues have also grown.

The industry’s downward trend is driven by growing High Throughput Satellite (HTS) competition, which has led to significantly lower capacity pricing in recent years. Video demand began to decrease in 2019, even before the pandemic and is set to continue in 2020, which also impacts FSS operators.

Given the recent COVID-19 indicators, the global economy could be impacted for months and potentially years to come. How strongly the pandemic impacts the FSS industry in 2021 and beyond remains to be seen. The overall situation is pushing a growing number of FSS operators to look for other sources of revenues. Notably, operators are turning to vertical integration to differentiate. This also enables them to offer better value to end users and blending managed services into their wholesale strategies empowers them to better manage bandwidth usage.

The pandemic has not slowed this trend, as highlighted by the recent acquisitions of Bigblu Broadband by Eutelsat (July 2020) and Gogo by Intelsat (September 2020), and it is expected to continue in coming years.

The “FSS Operators: Benchmarks & Performance Review” provides detailed analysis of 50 active FSS operators in a new interactive digital format that provides easy access to comparative data with customizable data sets, data filters, and new data search and visualization tools.

In the online benchmark section of the report, searchable indicators, which can be sorted by company, region, and in some cases by capacity type, include: regular supply, HTS supply, number of satellites in orbit, average fleet age, satellites to be launched, fill rates, capacity usage (both regular and HTS), video TV channels, number of DTH platforms, revenues by type of capacity, and revenues per transponder and per megabits per second.

Note: Profiles in the report are provided for all active FSS satellite operators. Satellite operators with a first satellite under construction or already ordered are also included in the future operator category. The study does not include profiles of vertically integrated operators and NGSO constellations. However, vertically integrated operators are included in the benchmark section of the report.