Chris Forrester — Just before the holiday the U.S. Congressional Research Service (a non-partisan research operation) released a study which addressed the potential to bridge the ‘digital divide’. There are filings with the International Telecommunication Union for some 1 million proposed non-Geosynchronous Orbit (GSO) satellites. This means multiple headaches for the regulators and existing operators.

Most recent work in the U.S. and in other developed countries have concentrated their efforts by boosting terrestrial connectivity with fibre — increasingly to the home — and ensuring that if ‘hard-wired’ telcos cannot reach the home then cellular operators can bridge the gap.

But if there’s no cellular then remote communities and business and individual users can only depend on satellite, and in the recent past there have been a handful of perfectly satisfactory suppliers in the shape of ViaSat, Iridium, Intelsat/SES, EchoStar/Hughes, Iridium and Globalstar/Apple to step into the void, albeit at a price!

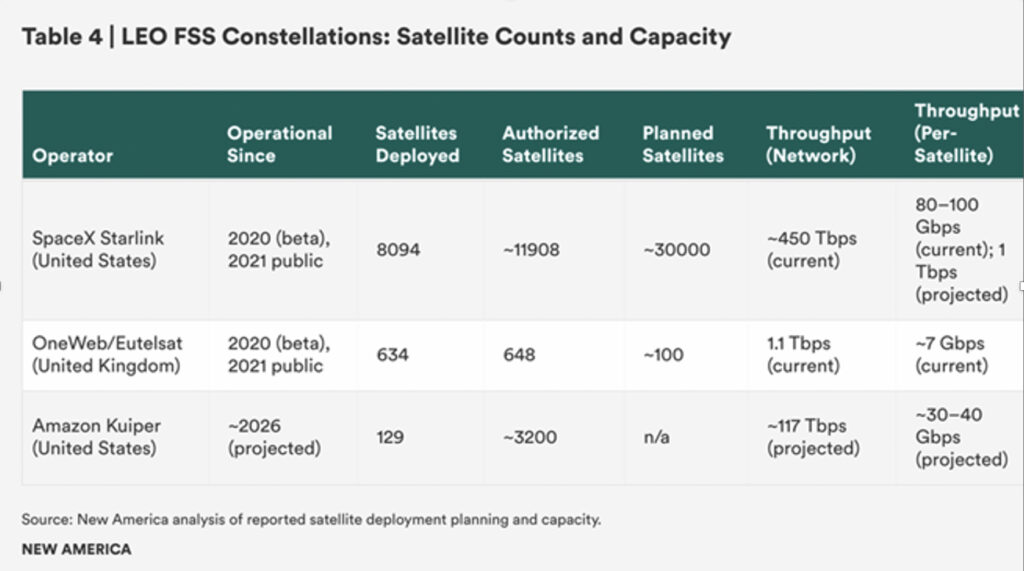

Now there’s Starlink and Eutelsat’s OneWeb, and during 2026 there will be rival satellite systems from AST SpaceMobile and Amazon Leo as well as the likes of Lynk Global and by 2027 Canada’s Lightspeed to provide competition and connectivity. Then there’s potential constellations from Viasat/Space42 and Greg Wyler’s E-Space as well as those from China and Russia. But adding tens of thousands of new orbiting satellites poses extreme risks, says a new highly detailed and comprehensive 160-page report from investment firm Summit Ridge Group (SRG).

SRG cautions that orbital space in Low Earth Orbit (LEO) is becoming increasingly crowded with communication satellites, and policy developments have simply failed to keep up. This report, prepared by the LEO Policy Working Group, seeks to provide policymakers with a forward-looking assessment of the evolving risks in space.

The study highlights three central themes that U.S. policymakers will need to address:

(1) enabling effective spectrum sharing and coexistence

(2) fostering a sustainable competitive environment in a rapidly evolving industry; and

(3) optimizing LEO connectivity’s role in closing the digital divide.

SRG’s work started some years ago and followed on from a series of Round Tables and the establishing of the LEO Satellite Forum. Over the past year, Wireless Future and ICLE brought together stakeholders with industry, public policy, academic, and regulatory expertise to explore the challenges facing the development and deployment of LEO satellites for universal connectivity.

The Forum has a distinguished panel of highly qualified members and top of their list of findings is that the current satellite-licensing system is overly slow, bespoke, and burdensome. “It could be improved by a shift to clear, uniform ex ante rules and conditions, with targeted ex post enforcement as needed. Second, the report endorses a new U.S.-led framework for satellite spectrum sharing, allowing higher power and more extensive spectrum access for LEOs in shared bands. Finally, a robust spectrum pipeline is needed to create far greater spectrum availability for both fixed satellite service (FSS) and mobile satellite service (MSS), which can be achieved through modern interference protection frameworks, coordinated sharing, and allocating more bands for satellite use.”

The report talks extensively of the threat to the existing satellite players from “foreign entities”. The report says: “In contrast to terrestrial broadband or other communications sectors where private demand has primarily set the pace,

LEO competition has been significantly shaped from the outset by state sponsorship, subsidies, and strategic mandates. At the same time, even private commercial systems controlled by foreign interests may pose a threat to these same political economy considerations, given long-standing concerns of foreign infrastructure and its tension with national security.”

These threats do not only mean the risks from (say) Chinese or Russian interference. There are many Mid-East countries, for example, where citizens are restricted from accessing non-local websites. The report says that this means LEO cannot be understood as a textbook competitive market; it is instead a hybrid arena where “strategic statecraft and economics continually overlap […] and distorts the market away from free-market competition.”

The FCC has promised to speed up its regulatory examinations of all satellite activity, but the pressures are considerable. The SRG study reminds readers that currently the FCC’s ‘in-tray’ holds an unprecedented number of LEO constellations which have been proposed in recent years. “Across four separate regulatory proceedings, over 20 entities have sought a license to provide FSS operations to the U.S. market alone. More than half of these planned systems have either been authorized or remain pending before the FCC. More broadly, filings before the ITU now reference more than one million proposed non-geostationary satellites. While the eventual realization of these proposed systems could reduce market concentration, such an outcome remains uncertain in the foreseeable future.”