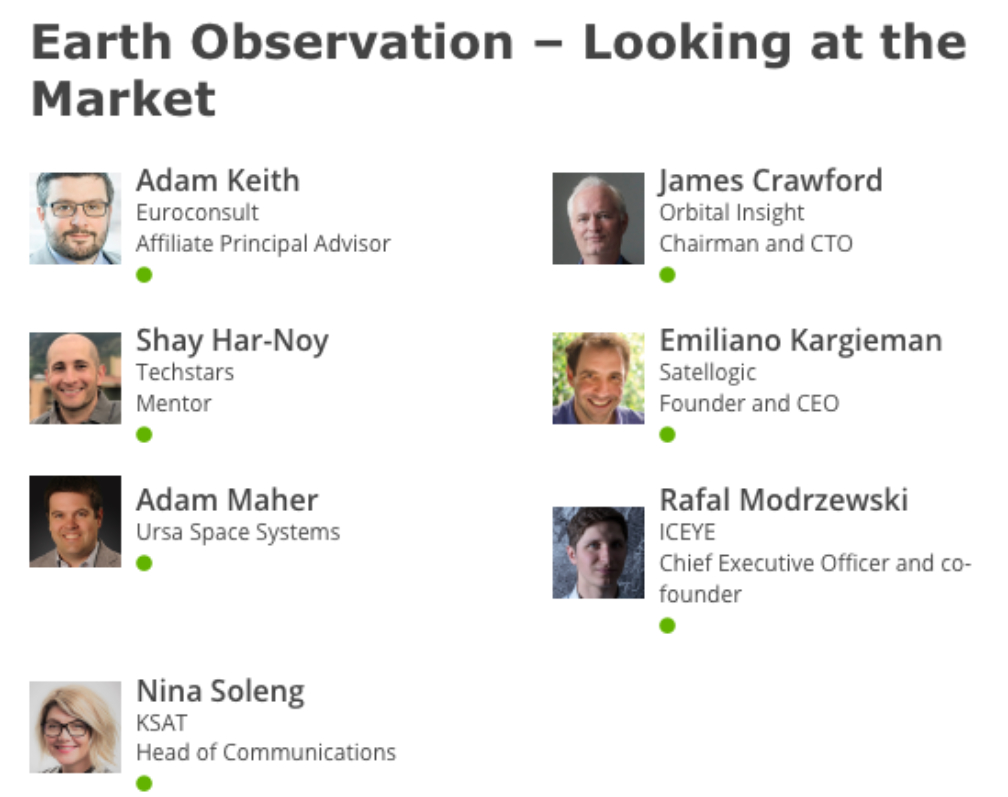

The moderator for this informative session on Earth Observation (E) was Adam Keith, the Affiliate Principal Advisor for Euroconsult. His initial inquiry was, what kind of products should the industry be building?

Shay Har-Noy (Techstars) — All should start from a use case and then figure out what technology to use to satisfy the customers. Value to the end-user must be shown. Companies must think about end-users and customers because it’s all about what value can be provided to them.

Adam Maher (Ursa Space Systems) — One of his main concerns was how do we educate the markets as to what these systems can do.

Nina Soleng (KSAT) — In spite of COVID, the company was able to run as usual (with more than 20,000 passes) and able to even hire more people in spite of COVID. There were some delays in expected tenders, the result of the firm’s exposure to the rise and fall in oil prices, one of their main end users. There should be multi-mission use of different technologies as well as new agreements with satellite operators and more ground stations should be built.

Rafal Modrzewski (ICEYE) — His company has recently launched three sats and other companies within this market segment have also launched a number of SAR satellites. The firm now has 10 completed. He is excited to see additional capacity coming online and the acceleration of smallsat launches. What is everyone going to do in the future? Data must be able to downloaded quickly as the real-time, global monitoring opportunity is very big and, over the next decade, will find increased demand for various industries. Companies must bring a lot of value across many different disciplines, such as natural disasters.

Adam Keith — What must companies be good at accomplishing? The one size fits all doesn’t work at all for EO. Should companies coming to market be specialized within one, two, or three specific markets?

Rafal Modrzewski — Use cases always require a different set of tools. There’s never going to be a single data set that can solve a specific problem. Core data is one of those, but it’s never enough. More and more constellations specialize in delivering specific data, but won’t be applicable to a single solution. Acquired data must merge with other data sets.

Emiliano Kargieman (Satellogic) — Twelve new satellites have been launched by his company since the onslaught of the pandemic. The company now has more capacity for data acquisition and it’s coming to a point where the firm can show what they’ve been working on. The pandemic has accelerated this trend for more data, particularly on the government side where there’s unsatisfied demand from more and more data. That market is showing an extremely strong demand. However, as an industry, the price point still remains too expensive for EO, and it’s all about the price point. Firms are trying to calculate what the tradeoffs are when dealing with what info can be collected and at a price point that makes sense to the customer, be they commercial or government. It’s simple to turn on faucet and get water and that ease-of-use is where EO firms need to get their data. Build apps for the customer who can open the data faucet and do what they need to do to get the information into users’ hands easily and quickly.

James Crawford (Orbital Insight) — A use case determines value. Pricing is incredibly differential. The supply chain creates the need for a company to price imagery very deferentially and must show the value of the imagery to the customer in order for their ROI to be acceptable. One image or thousands of images may both possess an identical value to different customers.

Shay Har-Noy — How much do we charge for the data? How much does it cost to install the sensors? If each water module in the previously mentioned water faucet analogy is used differently, pricing becomes challenging.

Nina Soleng — If we cannot provide what the customers wants, then they end up not buying at all. Access to data is still too complicated, thanks to licensing agreements, country restrictions and so on. Combinations of different sensors and providers result in different agreements or licensing. There is a need to see a more disruptive approach. The pre-paid value approach, that’s limiting to data access. Regional restraint through exclusive regional reseller agreements are problematic. If the end-user has difficulty getting what they want, they may end up not buying at all.

Adam Keith — Does the reseller market work?

Nina Soleng — With Oil & Gas, a company can have an agreement that is mainly based in one country but that firm then wants information from all over the world and agreement problems arise and there’s a lot of issues to get that client what they need from the area they want.

Rafal Modrzewski — The more use cases you can solve with the same image for the same site is a plus. Collection stacks are constant, the volume of data produced and used all have to work on the use cases to convert that data into value, one way or the other.

Adam Keith — What about orbital congestion? Is this of concern?

Rafal Modrzewski — He notes that this is becoming more of a problem. His company is trying to find a solution to it and a lot of work has gone into this situation. He does not believe this is a dire problem as of yet — his company performs collision avoidance maneuvers, but that is not a daily occurrence.

Nina Soleng — This is a huge opportunity for virtual Earth implementation to derive a solution that is needed by the industry.

James Crawford — He believes collision avoidance systems will happen. He also commented that sub-meter imagery is going to take a few more years to develop. The aim for success is to get sub-meter resolution to customers at a reasonable price point.