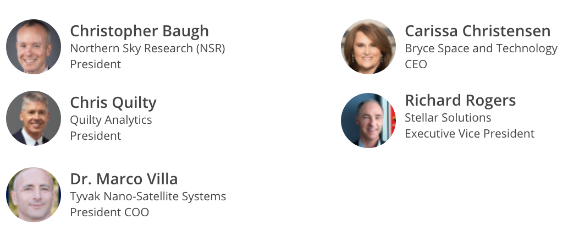

Satellite Innovation 2020 Virtual was off to a super start for the 732 attendees on October 6 with the “The State of the Satellite Industry” session, moderated by Christopher Baugh of NSR.

Satellite Innovation 2020 Virtual was off to a super start for the 732 attendees on October 6 with the “The State of the Satellite Industry” session, moderated by Christopher Baugh of NSR.

Participants Dr. Marco Villa of Tyvak Nano-Satellite Systems, Chris Quilty of Quilty Analytics, Carissa Christensen of Bryce Space and Technology and Richard Rogers of Stellar Solutions offered their thoughts regarding the “today” and “tomorrow” of the satellite and space environs.

Dr. Villa said that he didn’t believe many companies have had to shut down due to the coronavirus invasion and noted that there is a positive outlook by his company as well as the industry right now; however, the supply chain has “not been so lucky.”

Financial reporting was broached by Mr. Baugh and Mr. Quilty stated that three words come to mind for him… “resilience, dynamics and uncertainty” and there have been significant changes to the norm across the industry. The chessboard has shifted with all of these changes and operations are much harder now than they were five to 10 years ago. Many questions will come forward as all progress into the future and there will be a great deal to sort through during the next five to 12 months.

Carissa Christensen noted that some of the major primes that have an enormous aviation side to their business have been significantly impacted by the viral invasion and there has been “a reduced willingness to invest or allocate resources. Venture deals have been paused, except for brand new funding efforts.” She noted there has certainly been concern over reserving capital for company portfolios and the record breaking investments experienced over the past years won’t be seen this year.

Richard Rogers believes the biggest impact of the corona virus is the inability to interact with partners — the new normal is remote working versus the customer premises visits of the past.

Dr. Marco Villa sees the critical dependencies of the supply chain have definitely been affected. Those firms that were already positioned and working on vertical integration have been able to maneuver successfully through this health crisis, and those who were not so positioned are having a much harder time with their operations. Drastic changes are ahead.

Chris Baugh then asked the participants if “we are out of the woods,” given that there is so much in the way of business opportunity, new investments are occurring and money is attempting to find a home again. “Are we OK?” he asked.

Chris Quilty sees new growth and fresh starts in the industry that are being funded by venture capital and that’s something new for this industry. However, if healthy ideas aren’t developed over the next two to three yeas, that could be problematic for the industry. There are definitely government spending surges for satellite business as outsourcing to commercial entities continues.

Dr. Marco Villa doesn’t believe the industry is out of the woods yet, especially regionally, but there is a general optimistic outlook for the future.

Carissa Christensen stated that there is a certain level of uncertainty from investors. She agrees with Chris Quilty regarding government spending, as they are not short term users of the technology — U.S. and Allies’ national security concerns are becoming even more reliant on satellite. Growth is highly likely to continue and is relatively predictable on the government side. Space exploration, she added, is far more subject to political will. Increases to a NASA budget or other civil space projects tend to be bi-partisan — but, if there are administration changes post election, there could be some redirection and rolling back of resources to civil space that will affect a firm’s activities.

Chris Baugh commented that investment drives everything. Looking at trends taking place, he asked if is this an “up year” and, if so, what should be anticipated?

Carissa Christensen replied that this will not be a record breaking year, but it also won’t be a year when no one could raise money.

Richard Rogers added that he is seeing an uptick in business and investment companies are seriously looking at projects possessing AI enabled analytics.

Chris Baugh mentioned that there was another Starlink launch this morning (October 6), bringing to mind that ISS has had to maneuver 3x this year to dodge debris. Given that there is an overwhelming amount of activity from the industry into the LEO space, the question becomes where is this all going and how does it end? Is this the future for us all?

Carissa Christensen commented that it is important to remember that deployment does not equal biz success. Business failure does not mean the end of the capability. Broadband systems are being deployed, but… can they find customers? There are compelling business case aspects and significant risks to all involved. One of the topics that needs discussion is the carrying cost of a LEO broadband business.

Chris Quilty said that four or five years ago, when LEO first showed up, we were pretty doubtful about how that would be funded. At least three LEO band constellations — Amazon, SpaceX and OneWeb — have negotiated the funding aspects, so far. Companies will have to get a lot leaner if they are going to operate successfully.

Audience question included… Is GEO still relevant? Chris gave his thumbs up, but believes this will change. Starlink is leading the race, launching constantly, and the company has a lot of gateways in the US Canada… but, are they are a success? Chris said the determination as to Starlink’s success will be determined when we know how much more capital they need to raise. There’s huge investment necessary for the ground side of the biz and more investment will be needed in order to fund operations… just follow the dollars. He did add that one of the big LEOs must succeed in order to obtain investment from non-space investors. In regard to possible outcomes following the upcoming US elections, the general thought was that changes are unavoidable on the political side — this current administration hasn’t been one of the strongest in support of space, but spending should not substantially decrease. On the military side, there won’t be a lot of change. On the civil side, there will definitely be change — in FY22, things will get more challenging in regard to cash flow.

Mark Dankberg offered his keynote following Session 1, Equitable Access to Scarce NGSO Resources. He discussed the regularity environment within which the industry must operate, especially as new regulations are being formulated that will govern everyone’s access to space.

Mega-constellation require new legislation to preserve everyone’s access to space. He noted that unreliable satellites increase collision risks. Mega-constellations can deny access to spectrums and inefficient use consumes scarce orbital resources. New policies should balance the ability to commercialize space with the public interest in mind.

Two years ago, the FCC put out a proposal regarding orbital debris. One main point was that of the 100,000 objects between 1 and 10 cm, about 23,000 were associated with two fragmentation events from satellite collisions. In the last week or so, ESA provided information that revealed a large increase in payload fragmentation, with about 5,000 new payload fragments debuting. When collision occurs, very large debris fields (within 1600 kilometers in area size) are created.

AGI looked ten years ahead and noted that a lot of satellites will cross and this will become a very congested area. AGI estimated some 50,000 maneuvers will occur over 10 years. As Mark said, failed satellites cannot avoid collisions and debris can last for very long periods of time. The FCC has proposed an aggregate collision metric, and that makes a lot of sense to Mark. Debris policies should be addressed by the international satellite and space communities now!

During the LEO Band Developments panel, Dan Ceperley of LeoLabs, Jonathan Hofeller of SpaceX, Karl Kensinger of the FCC, and Tony Gingiss of OneWeb Satellites offered their expert opinions. Steve Kaufman of Hogan Lovells moderated the session. Questions presented to the panelists ranged from “Is there really that much demand for LEO service” to “what is the US Government involvement in supporting and using LEO satellites” to questions regarding space debris.

Jonathan Hofeller indicated without a doubt that high speed, super low latency connectivity is being provided by his firm and that he doesn’t see an end to demand anytime soon, as more and more connectivity is being demanded by users. He added that consumers don’t really care whether their broadband comes from space or not and LEO systems are capable of providing such connectivity. Jonathan said that companies learn a great deal by launching and operating satellites… in example, he presented the SpaceX challenge when confronted by astronomy professionals and their concerns regarding satellite reflectivity. Those challenges were quickly addressed on the firm’s next launch.

Tony Gingiss added that billions on the planet remain unconnected, including more than a half billion students across the globe as well as rural areas in the US that are not connected. “Absolutely,” he said, ”the demand for connectivity is there.” He added that, at the end of the day, it’s about the tech that was formulated 18 months ago and is now heading into operational orbit. In order to stay ahead of the curve, today’s new space tech should be heading to orbit in just quarters or months from now — the question is exactly how quickly new tech can enter operational service. There will always have to be proven tech in the satellite development mix, otherwise, failures will result. The barrier to success in space is much higher than for terrestrial-based solutions… if a space segment fails, the consequences will be bigger. Agility is required to get tech into space. He added that there are multi-pronged way to handle space debris — and one element is the way in which information is acquired. Putting up reliable systems is of crucial importance and that systems should work toward “responsible space,” from maintaining control of it to getting that satellite out of orbit to prevent additional debris should that craft become non-functional. Debris mediation cannot be addressed in “onesies” or “twosies.”

Dan Ceperley noted that connectivity is of critical importance and the number of programs within the federal government continue to move toward supporting the licensing of systems and continues to be area of focus. He said there is certainly unmet need “out there” and should be addressed as quickly as possible. Dan expressed that mega-constellations are driving the state of the satellite technology forward and that the LEO economy is maturing. In addition to broadband, Internet of Things (IoT) constellations are being developed. Definitely, the pace of innovation continues to be on the rise. When it comes to debris, three elements are present to prevent such from occurring: first, do not create problematic satellites in first place, secondly, engage in satellite tracking and work on avoidance issues. Ultimately, debris can be cleaned up and a tool for such space work is needed by the industry. Also, get rid of old, large rocket bodies that possess huge mass… one such rocket is capable of creating thousands of pieces of debris. Companies and the government can establish good policies in regard to offsetting LEO debris. Dan believes that satellites launched in batches need to be tracked directly after launch and ground operations must get in touch with those satellites immediately after launch to avoid on-orbit complications. His firm will be releasing a service to track satellites to remove that period of uncertainty after launch. Once the satellite reaches orbit, tracking and ground station contact concerns will become a distant memory.

Karl Kensinger reported that at his division at the FCC, they’re all about sats. Part of the FCC’s role is to support such development. Satellites are one part of an entire toolbox to address connectivity, service provisioning, and more. The FCC is glad to see developments in the satellite community; however, the government does not put all of their eggs in one basket. This is a rich tech environment and satellites have an important role. The FCC tries to advance those systems. His agency is working through licensing requests, but there are still some process issues. Improvements are being made. There is now a seat licensing program that should eventually provide a streamlined, lower registration costs. The FCC has three applications in the hopper at this point in time and continues to examine fees that were the result of legislation passed a couple of years ago. Proceedings will be underway at the FCC this week regarding orbital debris. Questions will deal with large constellations and its clear that large constellations recognize they have to take some extra steps in this endeavor due to their level of their activity. The other part are questions about tracking and data sharing and work is being done with FAA, DoD and other agencies to improve the processes already in place and the support the government provides. It is very clear that the way the industry is currently working, especially in LEO, is now at a different pace.

Pradman Kaul, the CEO of Hughes Network Systems, presented the second keynote presentation of Day One. He delved into some of the history behind the Hughes Network Systems company as well as some of his own past experiences, such as his work at Digital Communications Corporation, the precursor to Hughes.

Back then, he noted, they could never have imagined the services that are being offered today and that millions of users are now connected. When discussing powering the connected future, Pradman said that no single transport technology can meet all of the requirements for connectivity and won’t be able to do so today, nor in the future. Today’s hybrid net continues to evolve and all will soon see 5G deployed; however, none of these networks will operate in isolation. Applications must be agnostic no matter the mode of transportation used.

He noted that mega-constellations require sophisticated designs to offset environmental effects, such as rain fade, all the while providing increased capacity. The pressure will be on the network as more and more devices are being used simultaneously.

He acknowledged that no one predicted the demand for connectivity that the global pandemic would ignite. Networks must be built with the ability to be modified in real time and be able to adjust for unexpected surges with the ability to adjust for traffic demands. Payloads must be flexible to adjust capacity once on-orbit, requiring group networks to be as equally adaptable to conditions. Timing is critical. We are on the cusp of what is to come and intelligent networks must be capable of surviving critical events. The leap must be made to intelligent networks as traffic continues to grow.

The pandemic has been an eye opener on may levels and it is not an understatement to say it forced rapid, disruptive changes in our society. Business have or are learning how to be more proficient and productive, remotely. Engineers at Hughes are working on providing more broadband services, but demand will continue to outpace supply.

The best part of this industry is the ability to change the lives of millions of people and in knowing a difference has been made in their existence thanks to satellite connectivity. An element that remains unchanged throughout this entire pandemic is that the passion to meet customers’ needs and to explore new ways to make networks more useful and more powerful continues unabated.

SSPI’s 15th Future Leaders Celebration was held virtually in conjunction with the virtual Satellite Innovation 2020 conference, produced by Satnews publishers. The virtual Future Leaders Celebration was conducted live, via Zoom, and included breakout rooms for chatting and networking with colleagues throughout the industry. This inspiring and entertaining event, held October 6, 2020, honored the third annual cohort of the “20 Under 35” young space and satellite professionals to watch in the years ahead.

The 2020 Mentor of the Year is Dawn Harms, Chief Revenue Officer, Momentus Inc. A proven leader in the global satellite and launch services industry, Dawn formerly served as Vice President of Global Sales and Marketing at Boeing and has held executive positions at International Launch Services (ILS) and MAXAR. She received a BS degree in Electrical Engineering from the University of Wisconsin-Madison and has long served on their engineering advisory board. She is Chair Emeritus of SSPI and currently serves on ManSat’s board of directors. While serving in mission-critical executive roles, Dawn has always taken time to mentor the next generation, both at the companies where she works and by working with students looking to enter the industry.

2019 Awards

Daniel Alvarez, Space Mission Program Manager, Millennium Space Systems, A Boeing Company. At the age of 31, Dan has served and excelled in many roles since joining the Boeing Company. As a Mechanical Design Engineer, he was a key designer of Boeing’s Modular Reflector, which significantly reduced the cost of a reflector and is now baselined on all of Boeing’s largest commercial satellites. Dan’s current role at Millennium Space Systems is as a Space Mission Program Manager, where he is leading one of Millennium’s flagship programs. He was responsible for the first-ever implementation of an Earned Value Management System and Integrated Baseline Review at Millennium, and successfully led a competitive proposal effort to win the first two production Indefinite Delivery Indefinite Quantity delivery orders to build up the follow-on operational constellation.

Julian Horvath, Principal Engineer, Satellite Operations & Ground Development, Iridium. Julian began his career as a Systems Engineer at General Dynamics after receiving his Bachelor of Science in Space Physics from Embry-Riddle Aeronautical University. In his next position at Orbital Sciences Corporation, he led the systems engineering effort to design and implement an on-orbit data storage solution for all on-orbit vehicles, for which he received an award from the company. Julian joined Iridium in 2012 and was the youngest employee ever at the company to be promoted to Principal Engineer. In this position, Julian was tasked with leading the launch preparation, on-orbit testing, operational checkout and mission activation for Iridium NEXT, one of the largest constellations of commercial satellites ever launched.

Natalia Larrea Brito, Senior Affiliate Consultant, Euroconsult. Natalia completed a Master’s in Aerospace Engineering from McGill University (Montreal, Canada) and a Bachelor’s and Master’s in Telecommunications Engineering from Universidad Alfonso X El Sabio (Madrid, Spain). She also holds a Diploma in Astronomy and Planetary Science from the Open University UK and is a graduate of the International Space University (ISU) SSP14 program, for which she received SSPI’s International Scholarship that year. In her current role at Euroconsult, she manages research activities and consulting missions for government and private organizations in the space sector. She focuses on the assessment of government programs, new technologies and the strategic analysis of industrial and commercial space markets with special focus on space exploration. She supports and advises established and developing space players, assessing new satellite programs, defining new space policies and conducting socio-economic studies.

Some general thoughts from those registered as well as exhibiting at this event included appreciation for an interface that allowed visitors to “travel” to booths, attend presentations and discuss events with one another without difficulty, a testament to some terrific pre-show and interface planning.

Day Two at Satellite Innovation 2020